20161207 market watch iron ore

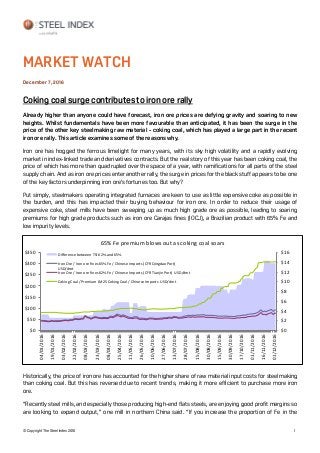

- 1. © Copyright The Steel Index 2016 1 MARKET WATCH December 7, 2016 Coking coal surge contributes to iron ore rally Already higher than anyone could have forecast, iron ore prices are defying gravity and soaring to new heights. Whilst fundamentals have been more favourable than anticipated, it has been the surge in the price of the other key steelmaking raw material - coking coal, which has played a large part in the recent iron ore rally. This article examines some of the reasons why. Iron ore has hogged the ferrous limelight for many years, with its sky high volatility and a rapidly evolving market in index-linked trade and derivatives contracts. But the real story of this year has been coking coal, the price of which has more than quadrupled over the space of a year, with ramifications for all parts of the steel supply chain. And as iron ore prices enter another rally, the surge in prices for the black stuff appears to be one of the key factors underpinning iron ore’s fortunes too. But why? Put simply, steelmakers operating integrated furnaces are keen to use as little expensive coke as possible in the burden, and this has impacted their buying behaviour for iron ore. In order to reduce their usage of expensive coke, steel mills have been sweeping up as much high grade ore as possible, leading to soaring premiums for high grade products such as iron ore Carajas fines (IOCJ), a Brazilian product with 65% Fe and low impurity levels. Historically, the price of iron ore has accounted for the higher share of raw material input costs for steelmaking than coking coal. But this has reversed due to recent trends, making it more efficient to purchase more iron ore. “Recently steel mills, and especially those producing high-end flats steels, are enjoying good profit margins so are looking to expand output,” one mill in northern China said. “If you increase the proportion of Fe in the $0 $2 $4 $6 $8 $10 $12 $14 $16 $0 $50 $100 $150 $200 $250 $300 $350 04/01/2016 19/01/2016 03/02/2016 22/02/2016 08/03/2016 23/03/2016 08/04/2016 25/04/2016 11/05/2016 26/05/2016 10/06/2016 27/06/2016 13/07/2016 28/07/2016 15/08/2016 30/08/2016 15/09/2016 30/09/2016 17/10/2016 01/11/2016 16/11/2016 01/12/2016 65% Fe premium blows out as coking coal soars Difference between TSI 62% and 65% Iron Ore / Iron ore fines 65% Fe / Chinese Imports (CFR Qingdao Port) USD/dmt Iron Ore / Iron ore fines 62% Fe / Chinese Imports (CFR Tianjin Port) USD/dmt Coking Coal / Premium JM25 Coking Coal / Chinese Imports USD/dmt

- 2. © Copyright The Steel Index 2016 2 burden mix, you can lower the percentage of coke used and also raise iron output,” he explained. “That is why lots of mills are trying to buy high grade fines: on the one hand, you lower your costs, and on the other, you maximize your profit”. On December 2, the TSI JM 25 Coking Coal Chinese imports index stood at US$308.6/tonne, up 218% from July 1, 2016. Over the same period, the TSI 62% Fe iron ore benchmark rose 44%.The increase in the TSI 65% Fe iron ore index has been even greater, standing 62% higher than at the beginning of the second half of 2016. The surge in demand for high grade ores has led to a dearth of availability, both for seaborne material and in the secondary market for port stocks in China. “IOCJ is limited in volume and high in price along the coastal ports: we call it the Hermes of iron ore now”, one port stock trader explains, noting its premium over 61-61.5% Fe grade PB Fines from Australia has doubled from RMB 50/wmt to RMB 100/wmt. And with declining availability of 65% Fe ores, buyers have been eagerly seeking out the next best thing. Some Chinese mills have sought out domestic concentrate, which is also typically high in Fe and lower in cost. But following years of closures at Chinese mines and troublesome logistics, availability is still thin. This has led to a demand boost for medium grade imported ores out of Western Australia, which are typically the benchmark grades which form the bedrock of spot trade. Commonly traded Australian products such as Pilbara Blend Fines also contain low silica, which also helps lower coke usage, further reducing the need for expensive coking coal purchases. Unsurprisingly, the gap between the 62% Fe and 58% Fe indices has also widened as participants place a premium on additional Fe units and lower impurities. “There used to be RMB 30-50/wmt price gap between Pilbara Blend (PB) Fines (61%) and Yandi Fines (57.2%)”, a trader at Rizhao port noted. “Now the difference is RMB120-140/wmt.” In November the gap has, however, widened so far that buyers, now priced out of the 62% market, are again picking up low grade materials. “There is obviously a limit as to how far you can lower your coke rate,” the trader said. More recently, iron ore prices have received a fillip from a spike in the on-shore futures markets. The widely traded Chinese iron ore futures contract on the Dalian Commodities Exchange (DCE) has seen huge inflows of interest from domestic funds looking to hedge against a weakening Chinese yuan, as well as a surge on global expectations of a splurge on infrastructure by the incoming US administration. And in recent weeks, premiums on index-linked (otherwise known as floating price deals) have soared for a number of popular products, putting strain on contractual agreements where products typically are sold on a flat-to-index price level. Last week, Australian mining giant Rio Tinto reportedly asked for an additional dollar premium for contractual shipments of its PB Fines product, which has traded in the spot market with premiums of more than US$4/dmt over index, leading to reports of mills in China re-selling contractual tonnages into the spot market in an echo of the issues which broke the annual benchmark system in 2010. Whilst Chinese steel output is trending down towards 2016 year-end and may see further impact from environmental regulations this winter, few see much near-term relief from the coking coal pricing side. The only thing for certain is that volatility is here to stay.

- 3. © Copyright The Steel Index 2016 3 Please contact: Oscar Tarneberg o.tarneberg@thesteelindex.com + 86 13917 884 804 Kennith Yan yukun.yan@thesteelindex.com Note to Editors: The Steel Index (TSI) is a leading specialist source of impartial steel, scrap, iron ore and coking coal price information based on spot market transactions. Transaction price data is submitted confidentially to TSI on-line by companies buying and selling a range of relevant steel, iron ore, scrap, coking coal products. TSI’s index reference prices are then calculated using transparent and verifiable procedures which are fully aligned with IOSCO principles. TSI’s iron ore and coking coal price indices are published daily at 18:30 Singapore/Shanghai time (10:30 GMT). Steel prices for Northern Europe, Southern Europe and US HRC are published daily at 14:00 UK time and for ASEAN HRC imports daily at 18:30 Singapore time. Scrap prices for Turkish imports are published daily at 13:30 UK time. Weekly steel and scrap price indices are published every Monday and Friday respectively, with each price representing the average transaction price for the previous calendar week. TSI’s indices are widely used by steel mills, miners, traders, distributors and manufacturing companies worldwide as the basis for their physical pricing arrangements. TSI’s indices are also used as the industry standard in the settlement of ferrous financial contracts. Singapore Exchange (SGX), LCH (London), CME Group (Chicago), NASDAQ OMX Clearing (Oslo), European Energy Exchange (EEX) and Intercontinental Exchange (ICE) all use TSI’s iron ore index for settling their monthly cleared iron ore financial contracts. SGX also uses TSI’s coking coal indices and hot rolled coil index for ASEAN imports to settle its coking coal and Asian HRC steel futures and swap contracts respectively. In addition, TSI’s prices are used for the settlement of European hot rolled coil steel contracts on LCH and CME Clearing Europe, the settlement of Turkish scrap imports contracts on LCH, LME, CME Europe and Borsa Istanbul, and a domestic US scrap contract on NASDAQ OMX Clearing. In all cases, settlement prices are the average of TSI’s reference prices published in the expiring month. TSI is a Platts business, part of S&P Global. Further information on TSI, including a free trial of the service, is available at http://www.thesteelindex.com. At S&P Global Platts, we provide the insights; you make better informed trading and business decisions with confidence. We’re the leading independent provider of information and benchmark prices for the commodities and energy markets. Customers in over 150 countries look to our expertise in news, pricing and analytics to deliver greater transparency and efficiency to markets. S&P Global Platts coverage includes oil and gas, power, petrochemicals, metals, agriculture and shipping. S&P Global Platts is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies and governments to make decisions with confidence. For more information, visit www.platts.com. This information has been prepared by The Steel Index ("TSI"). Use of the information presented here is at your sole risk, and any content, material and/or data presented or otherwise obtained through your use of the information in this document is at your own discretion and risk and you will be solely responsible for any damage to you personally or your company or organisation or business associates whatsoever which in anyway results from the use, reliance or application of such content material and/or information. Certain data has been obtained from various sources (listed on the final page) and any copyright existing in such data shall remain the property of the source. Except for the foregoing, TSI retains all copyright within this document. The copying or redistribution of any part of this document without the express written authority of TSI is forbidden.