Improving Dispute Resolution For You

•

0 j'aime•278 vues

Company names mentioned herein are the property of, and may be trademarks of, their respective owners and are for educational purposes only.

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

Contenu connexe

Plus de - Mark - Fullbright

Plus de - Mark - Fullbright (20)

Advisory to Financial Institutions on Illicit Financial Schemes and Methods R...

Advisory to Financial Institutions on Illicit Financial Schemes and Methods R...

Protecting Personal Information: A Guide for Business

Protecting Personal Information: A Guide for Business

Consumer Sentinel Network Data Book for January 2016 - December 2016

Consumer Sentinel Network Data Book for January 2016 - December 2016

DEBT RELIEF SERVICES & THE TELEMARKETING SALES RULE: A Guide for Business

DEBT RELIEF SERVICES & THE TELEMARKETING SALES RULE: A Guide for Business

Dernier

https://app.box.com/s/71kthbth9ww0fyjrppmh1p2gasinqj5zĐỀ THAM KHẢO KÌ THI TUYỂN SINH VÀO LỚP 10 MÔN TIẾNG ANH FORM 50 CÂU TRẮC NGHI...

ĐỀ THAM KHẢO KÌ THI TUYỂN SINH VÀO LỚP 10 MÔN TIẾNG ANH FORM 50 CÂU TRẮC NGHI...Nguyen Thanh Tu Collection

https://app.box.com/s/z2cfx5b2yooxq1ov1wrd1dezn6af36uxBỘ LUYỆN NGHE TIẾNG ANH 8 GLOBAL SUCCESS CẢ NĂM (GỒM 12 UNITS, MỖI UNIT GỒM 3...

BỘ LUYỆN NGHE TIẾNG ANH 8 GLOBAL SUCCESS CẢ NĂM (GỒM 12 UNITS, MỖI UNIT GỒM 3...Nguyen Thanh Tu Collection

Dernier (20)

MSc Ag Genetics & Plant Breeding: Insights from Previous Year JNKVV Entrance ...

MSc Ag Genetics & Plant Breeding: Insights from Previous Year JNKVV Entrance ...

Đề tieng anh thpt 2024 danh cho cac ban hoc sinh

Đề tieng anh thpt 2024 danh cho cac ban hoc sinh

ĐỀ THAM KHẢO KÌ THI TUYỂN SINH VÀO LỚP 10 MÔN TIẾNG ANH FORM 50 CÂU TRẮC NGHI...

ĐỀ THAM KHẢO KÌ THI TUYỂN SINH VÀO LỚP 10 MÔN TIẾNG ANH FORM 50 CÂU TRẮC NGHI...

BỘ LUYỆN NGHE TIẾNG ANH 8 GLOBAL SUCCESS CẢ NĂM (GỒM 12 UNITS, MỖI UNIT GỒM 3...

BỘ LUYỆN NGHE TIẾNG ANH 8 GLOBAL SUCCESS CẢ NĂM (GỒM 12 UNITS, MỖI UNIT GỒM 3...

Including Mental Health Support in Project Delivery, 14 May.pdf

Including Mental Health Support in Project Delivery, 14 May.pdf

The Liver & Gallbladder (Anatomy & Physiology).pptx

The Liver & Gallbladder (Anatomy & Physiology).pptx

Sternal Fractures & Dislocations - EMGuidewire Radiology Reading Room

Sternal Fractures & Dislocations - EMGuidewire Radiology Reading Room

UChicago CMSC 23320 - The Best Commit Messages of 2024

UChicago CMSC 23320 - The Best Commit Messages of 2024

Envelope of Discrepancy in Orthodontics: Enhancing Precision in Treatment

Envelope of Discrepancy in Orthodontics: Enhancing Precision in Treatment

Improving Dispute Resolution For You

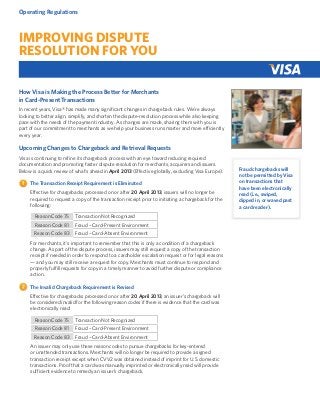

- 1. Operating Regulations Improving Dispute Resolution for You How Visa is Making the Process Better for Merchants in Card-Present Transactions In recent years, Visa® has made many significant changes in chargeback rules. We’re always looking to better align, simplify, and shorten the dispute-resolution process while also keeping pace with the needs of the payment industry. As changes are made, sharing them with you is part of our commitment to merchants as we help your business run smarter and more efficiently every year. Upcoming Changes to Chargeback and Retrieval Requests Visa is continuing to refine its chargeback process with an eye toward reducing required documentation and promoting faster dispute resolution for merchants, acquirers and issuers. Below is a quick review of what’s ahead in April 2013 (Effective globally, excluding Visa Europe). The Transaction Receipt Requirement is Eliminated Effective for chargebacks processed on or after 20 April 2013, issuers will no longer be required to request a copy of the transaction receipt prior to initiating a chargeback for the following: Reason Code 75 Transaction Not Recognized Reason Code 81 Fraud – Card-Present Environment Reason Code 83 Fraud – Card-Absent Environment For merchants, it’s important to remember that this is only a condition of a chargeback change. As part of the dispute process, issuers may still request a copy of the transaction receipt if needed in order to respond to a cardholder escalation request or for legal reasons — and you may still receive a request for copy. Merchants must continue to respond and properly fulfill requests for copy in a timely manner to avoid further dispute or compliance action. The Invalid Chargeback Requirement is Revised Effective for chargebacks processed on or after 20 April 2013, an issuer’s chargeback will be considered invalid for the following reason codes if there is evidence that the card was electronically read: Reason Code 75 Transaction Not Recognized Reason Code 81 Fraud – Card-Present Environment Reason Code 83 Fraud – Card-Absent Environment An issuer may only use these reason codes to pursue chargebacks for key-entered or unattended transactions. Merchants will no longer be required to provide a signed transaction receipt except when CVV2 was obtained instead of imprint for U.S. domestic transactions. Proof that a card was manually imprinted or electronically read will provide sufficient evidence to remedy an issuer’s chargeback. Fraud chargebacks will not be permitted by Visa on transactions that have been electronically read (i.e., swiped, dipped in, or waved past a card reader).

- 2. Process Effective April 2013 No chargeback rights Cardholder disputes transaction Was card electronically read? Existing chargeback process Represent with imprint or Signature with CVV2* *Signature with CVV2 applies to U.S. domestic only. What it Means for Merchants Rule changes are intended to speed up the dispute resolution process without compromising the integrity of the chargeback process. For merchants, the retrieval request elimination and invalid chargeback requirement will mean: – Streamlined chargeback and documentation requirements – Simplified dispute resolution process (fraud chargebacks will not be permitted on electronically read transactions) – Reduced back-office handling and related fraud management costs Merchants must continue to: – Respond to retrieval requests in a timely manner to avoid compliance action and associated fees – Capture the cardholder’s signature at the point of sale for transactions not eligible for Visa Easy Payment Service – Follow fraud prevention steps during transaction processing These changes will simplify the dispute resolution process, minimize operational costs, and reduce copy requests received by merchants. And it will also help create a degree of flexibility intended to improve chargeback-processing efficiencies. Merchants should NOT receive fraud chargebacks if card is electronically read and correct acceptance procedures are followed at the point of sale. Monitoring Chargebacks To help ensure that acquirers and issuers are not negatively impacted by these rules changes, Visa will implement a monitoring and compliance program to make certain that fraud rules are properly followed and to monitor unusual spikes in dispute activity. In addition, merchant point-of-sale procedures will be monitored to ensure that signature requirements are being followed as set forth in the Visa International Operating Regulations. Visa offers a number of risk and chargeback management materials as part of its merchant education program. To download these guides visit www.visa.com/merchants. KEY-ENTERED CHARGEBACKS ACCEPTANCE Merchant Card Acceptance Process for Magnetic-Stripe Failures at the Point of Sale (U.S. domestic only) U.S. merchants in the face-to-face sales environment may include CVV2 in the authorization request for U.S. domestic key-entered transactions in lieu of taking a manual card imprint. Chargeback Management Guidelines for Visa Merchants covers chargeback requirements and best practices for processing transactions that are charged back to the merchant. Card Acceptance Guidelines for Visa Merchants provides merchants and their sales staff with accurate, up-to-date information and best practices for processing Visa transactions. For more information, contact your acquiring bank, processor or Visa representative today. © 2012 Visa. All Rights Reserved. VPC 05.07.12