Valuation Model for Professional Services Firm

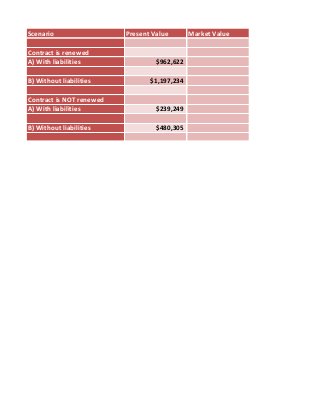

- 1. Scenario Present Value Contract is renewed A) With liabilities $962,622 B) Without liabilities $1,197,234 Contract is NOT renewed A) With liabilities $239,249 B) Without liabilities $480,305 Market Value

- 2. Free Cash Flow Valuation -- Professional Services Firm (Modifying variables in red will dynamically update the MV of the company) Forecasting Variables: 2013 2014 2015 2016 2017 2018 2019 2020 2021 Revenue growth factor 35% 35% 35% 30% 30% 30% 20% 20% 20% Expected gross profit margin 18% 19% 20% 20% 21% 22% 22% 23% 24% S, G, & A expense % of revenue 20% 21% 21% 22% 23% 24% 25% 25% 26% Depr. & Amort. % of revenue 4% 4% 4% 4% 5% 5% 5% 5% 5% 2013 2014 2015 2016 2017 2018 2019 2020 2021 ($16,989) ($838) Income tax rate Assumed long-term sustainable growth rate Discount rate 35% 4.72% per year after 2022 11.22% Valuation Model Outputs: Free cash flow Terminal value PV of Company Operations ($ mil) Add: Total Assets Less: Total Liabilities Market Value of Company Assets ($ mil) $848 $25,961 $4,963 $29,035 $37,745 ($20,131) $54,353 $1,077,589 $126,089.0 $241,056.0 $962,622 Note 1: Long Term Growth Rate The long term GDP growth rate from 1947-2010 was 3.23%. Using the industry Beta of 1.46 as a proxy for sustainable growth rate above the average growth rate of the economy, the long term growth rate assumption is 4.72%. Note that infinite growth above trend GDP is only reasonable because higher betas imply greater risk of insolvency. If the company survives, a long term growth rate above average GDP is reasonable. Data obtained from: http://www.tradingeconomics.com/united-states/gdp-growth Note 2: Total Liabilities I used total liabilities because they represent the obligations of the company, unless discharged in the merger. If you want to use long term liabilities, use $131,096 in cell C22

- 4. The Discounted Free Cash Flow Model for A Professional Services Firm Actual 2012 Total revenue Cost of Goods Sold Years Ending December 31 |------------------------------------------------------------------------------------------ Forecast ----------------------------------------------------------------------------------------| 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 $1,551,738 $2,094,846 $2,828,043 $3,817,857 $4,963,215 $6,452,179 $8,387,833 $10,065,399 $12,078,479 $14,494,175 $17,393,010 1,270,527 1,717,774 2,290,714 3,054,286 3,970,572 5,097,221 6,542,509 7,851,011 9,300,429 11,015,573 13,044,757 Gross profit 281,211 377,072 537,328 763,571 992,643 1,354,958 1,845,323 2,214,388 2,778,050 3,478,602 4,348,252 Selling, general and administrative expenses 312,474 418,969 593,889 801,750 1,091,907 1,484,001 2,013,080 2,516,350 3,019,620 3,768,485 4,522,183 Earnings before interest, taxes, depr. & amort. (EBITDA) (31,263) (41,897) (56,561) (38,179) (99,264) (129,044) (167,757) (301,962) (241,570) (289,883) 9,520 75,414 107,466 145,079 198,529 322,609 419,392 503,270 603,924 724,709 Earnings before Interest and taxes (EBIT) Net taxable earnings (40,783) (40,783) (117,311) (117,311) (164,026) (164,026) (183,257) (183,257) (297,793) (297,793) (451,653) (451,653) (587,148) (587,148) (805,232) (805,232) (845,494) (845,494) (1,014,592) (1,014,592) (1,043,581) (1,043,581) Federal and State Income Taxes (14,274) (41,059) (57,409) (64,140) (104,228) (158,078) (205,502) (281,831) (295,923) (355,107) (365,253) Net Operating Profit After-Tax (NOPAT) (26,509) (76,252) (106,617) (119,117) (193,565) (293,574) (381,646) (523,401) (549,571) (659,485) (678,327) 9,520 75,414 Depreciation and amortization Add back depreciation and amortization Free Cash Flow 869,650 107,466 145,079 198,529 322,609 419,392 503,270 603,924 724,709 869,650 ($838) $848 $25,961 $4,963 $29,035 $37,745 ($20,131) $54,353 $65,224 $191,323 $2,943,431 $913,781 (753) ($16,989) 686 18,870 3,244 17,061 19,942 (9,563) 23,215 25,047 66,060 Terminal Value, 2023 Terminal Value, 2013 Present Value of Free Cash Flows @ 11.22% Total Present Value of Company Operations $1,077,589 Plus Current Assets $ 119,645 Total Market Value of Great Expectations' Assets (173,930) $1,197,234

- 5. Free Cash Flow Valuation -- Professional Services Firm (Modifying variables in red will dynamically update the MV of the company) Forecasting Variables: 2013 2014 2015 2016 2017 2018 2019 2020 2021 Revenue growth factor 35% 35% 35% 30% 30% 30% 20% 20% 20% Expected gross profit margin 18% 19% 20% 20% 21% 22% 22% 23% 24% S, G, & A expense % of revenue 20% 21% 21% 22% 23% 24% 25% 25% 26% Depr. & Amort. % of revenue 4% 4% 4% 4% 5% 5% 5% 5% 5% 2014 2015 2016 2017 2018 2019 2020 2021 Income tax rate Assumed long-term sustainable growth rate Discount rate 35% 4.72% per year after 2022 11.22% 2013 Valuation Model Outputs: Free cash flow Terminal value PV of Company Operations ($ mil) Add: Total Assets Less: Total Liabilities Market Value of Company Assets ($ mil) ($275) $279 $8,534 $1,631 $9,544 $12,407 ($6,617) $17,867 $21,440 $354,216 $126,089.0 $241,056.0 $239,249 Note 1: Long Term Growth Rate The long term GDP growth rate from 1947-2010 was 3.23%. Using the industry Beta of 1.46 as a proxy for sustainable growth rate above the average growth rate of the economy, the long term growth rate assumption is 4.72%. Note that infinite growth above trend GDP is only reasonable because higher betas imply greater risk of insolvency. If the company survives, a long term growth rate above average GDP is reasonable. Data obtained from: http://www.tradingeconomics.com/united-states/gdp-growth Note 2: Total Liabilities I used total liabilities because they represent the obligations of the company, unless discharged in the merger. If you want to use long term liabilities, use $131,096 in cell C22

- 7. The Discounted Free Cash Flow Model for Professional Services Firm Actual 2012 Total revenue $510,076 Cost of Goods Sold 1,270,527 Gross profit Selling, general and administrative expenses Earnings before interest, taxes, depr. & amort. (EBITDA) Depreciation and amortization Earnings before Interest and taxes (EBIT) Net taxable earnings Years Ending December 31 |------------------------------------------------------------------------------------------ Forecast ----------------------------------------------------------------------------------------| 2013 2014 2015 2016 2017 2018 2019 2020 2021 $688,603 $929,614 $1,254,978 $1,631,472 $2,120,913 $2,757,187 $3,308,625 $3,970,350 $4,764,419 564,654 752,987 1,003,983 1,305,177 1,675,521 2,150,606 2,580,727 3,057,169 3,620,959 (760,451) 123,948 176,627 250,996 326,294 445,392 606,581 727,897 913,180 1,143,461 312,474 137,721 195,219 263,545 358,924 487,810 661,725 827,156 992,587 1,238,749 (13,772) (18,592) (12,550) (32,629) (42,418) (55,144) (99,259) (79,407) (1,072,925) 9,520 (1,082,445) (1,082,445) (95,288) 24,790 35,325 47,689 65,259 106,046 137,859 165,431 198,517 238,221 (38,562) (38,562) (53,918) (53,918) (60,239) (60,239) (97,888) (97,888) (148,464) (148,464) (193,003) (193,003) (264,690) (264,690) (277,924) (277,924) (333,509) (333,509) Federal and State Income Taxes (378,856) (13,497) (18,871) (21,084) (34,261) (51,962) (67,551) (92,641) (97,274) (116,728) Net Operating Profit After-Tax (NOPAT) (703,590) (25,065) (35,046) (39,155) (63,627) (96,502) (125,452) (172,048) (180,651) (216,781) 24,790 Add back depreciation and amortization Free Cash Flow 9,520 35,325 47,689 65,259 106,046 137,859 165,431 198,517 238,221 ($275) $279 $8,534 $1,631 $9,544 $12,407 ($6,617) $17,867 $21,440 (248) ($694,069) 225 6,203 1,066 5,608 6,555 (3,143) 7,631 8,233 Terminal Value, 2023 Terminal Value, 2013 Present Value of Free Cash Flows @ 11.22% Total Present Value of Company Operations $354,216 Plus Total Assets $ 126,089 Total Market Value of Great Expectations' Assets $480,305

- 9. Professional Services Firm Discount Rate Determination 100 Year Average US 10-year Treasury Yield: Average Equity Risk Premium Industry Beta Expected Return from CAPM Discount Rate ( r ) 4.90% 4.33% 1.46 11.22% 11.22% Note 1: 100 Year Average Treasury Yield 100 year average 10-year US treasury rate of 4.90% was obtained from: http://observationsandnotes.blogspot.com/2010/11/100-years-of-bond-interest-rate-history.html Note 2: Average Equity Risk Premium The annual compounded return on the US equity composite index for the 1928-2011 time period was 9.23%. The annual compounded return from US Treasury rates was 4.90% for the same period. The difference (4.33%) is the equity risk premium for the composite stock market. The annual compounded return data was obtained from: http://aswathdamodaran.blogspot.com/2012/03/equity-risk-premiums-2012-edition.html Note 3: Industry Beta The industry I used to compare R.A.D. is the "Human Resources" sector. Summary Statistics Industry Name Human Resources # Firms 25 Unlevere Avg. Beta D/E Ratio Tax Rate d Beta 1.38 10.80% 26.61% 1.28 Cash/Firm Value Unlevered Beta corrected for cash 12.49% 1.46 I chose the unlevered Beta corrected for cash due to R.A.D.'s low cash position. The average Beta (1.38) is very close, and either number would work. Data obtained from: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/Betas.html Note 4: Discount Rate Derived from CAPM The Capital Asset Pricing Model (CAPM): Expected Return ( r ) = Risk free rate + Beta(Equity Risk Premium) r = 4.9 + 1.46(4.33) r = 11.22%

- 10. Fixed assets: Computer Equipment Accumulated Depreciation (Computer Equipment) Computer Software Accumulated Depreciation (Software) Furniture and Fixtures Accumulated Depreciation (FF&E) Motor Vehicles Accumulated Depreciation (Motor Vehicles) Total fixed assets 2012 8,860.00 (7,990.00) 1,686.00 (1,685.00) 12,556.00 (12,360.00) 33,359.00 (27,982.00) 6,444.00 Depreciable Basis $8,860.00 Yearly Depreciation Expense $1,772.00 $1,686.00 $12,556.00 $2,511.20 $33,360.00 Sum: $337.20 $6,672.00 $56,462.00 Sum: $9,520.40 Note 1: Yearly depreciation and amortization expense calculated by assuming a 5 year useful life and straight line depreciation Note 2: Depreciation and amortization expense is added back to EBITDA to determine FCFF Note 3: The depreciable basis is calculated as the book value (cost) of the asset less the balance in the associated accumulated depreciation account Note 4: New investment in PP&E will use the same 5 year useful life and straight line depreciation method to add to EBITDA to come up with FCFF

- 12. Professional Services Firm Revenue Gross sales Less sales returns and allowances Net sales Cost of Sales Salaries Payroll Taxes Commissions Health Insurance Reference Checks Total COGS Gross profit (loss) Operating Expenses Income Statement Year to Date Amount $1,558,779 (7,041) 1,551,738 Amount $1,095,795 $127,206 $17,157 $30,009 $360 $1,270,527 $281,211 % of Sales 100% Year to Date % of Sales 71% 8% 1% 2% 0% 82% 18% Year to Date Amount % of Sales $2,049 $1,976 $645 $5,051 $68 $580 $1,397 $10 $595 $271 $45,583 $2,086 $3,598 $13,058 $35 $9,196 $12,489 $1,846 $2,165 $4,227 $34,555 $163,249 $500 $759 $4,032 $2,454 312,474 ($31,263) 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 3% 0% 0% 1% 0% 1% 1% 0% 0% 0% 2% 11% 0% 0% 0% 0% 20% Selling, General and Administrative (SG&A) Advertising Auto Expense Bad Debt Expense Bank Service Charges Client Lunch Computer Expense Dues and Subscriptions Employee Relations Entertainment Gifts Insurance Legal and Accounting Office Expenses Outside Services Parking Payroll Expenses Payroll Taxes Postage and Delivery Printing and Reproduction Profit Sharing Rent Salaries and wages Suspense Taxes -- Other Telephone Utilities Total SG&A Net income before taxes

- 13. Taxes on income Net income after taxes Extraordinary gain or loss Income tax on extraordinary gain Net Income (Loss) $0 ($31,263) $0 $0 ($31,263)

- 14. Professional Services Firm Balance Sheet Assets Current assets: Cash Accounts Receivable Allowance for Bad Debts Officer's Loan Receivable Deposits Total current assets 2012 9,950.00 112,151.00 (10,000.00) 4,132.00 3,412.00 119,645.00 Fixed assets: Computer Equipment Accumulated Depreciation (Computer Equipment) Computer Software Accumulated Depreciation (Software) Furniture and Fixtures Accumulated Depreciation (FF&E) Motor Vehicles Accumulated Depreciation (Motor Vehicles) Total fixed assets 2012 8,860.00 (7,990.00) 1,686.00 (1,685.00) 12,556.00 (12,360.00) 33,359.00 (27,982.00) 6,444.00 Total assets 126,089.00 Liabilities and owner's equity Current liabilities: Credit Cards Cash Overdraft 401K Contributions Payable Federal W/H and FICA Payable MA W/H Payable FUTA Payable SUI & MA Health Payable Child Support Payable Total current liabilities 2012 24,236.00 3,500.00 (200.00) 65,293.00 530.00 200.00 16,215.00 186.00 109,960.00 Long-term liabilities: Accrued State Income Taxes Deferred Income Taxes Reserve Credit -- Fleet Fleet -- Loan Payable Sovereign Credit Line Total long-term liabilities 2012 Owner's equity: 2012 456.00 5,858.00 13,922.00 36,097.00 74,763.00 131,096.00

- 15. Common Stock Retained Earnings Net Income Total owner's equity Total liabilities and owner's equity 3,175.00 (53,404.00) (64,738.00) (114,967.00) 126,089.00

- 16. Line Item Growth Factors and Assumptions Revenue Growth Factor: Comparable competitor, On Assignment (ASGN), five year TTM revenues: 12 months 12 months 12 months ending 2011- ending 2010- ending 200912-31 12-31 12-31 Revenues ($MM) 597.28 438.06 416.61 Average Annual Compound Growth Rate 20% Gross Profit Growth Factor: Current growth profit percentage is 18%, assume will gradually increase to ASGN's gross profit percentage to 25% (ASGN at 34% for reference) 25% Selling, General and Administrative as a Percent of Revenues Growth Factor: Current SG&A expense as a percent of revenues is 20% Assume gradually increase to ASGN's SG&A percent of revenues of 25% (ASGN at 26% for reference) 26% Depreciation and Amortization as a Percent of Revenues Growth Factor Current SG&A expense as a percent of revenues is 3.6% Assume gradually increase to ASGN's SG&A expense percent of revenus of 5% 5%