1. Kayak Co. budgeted the following cash receipts (excluding cash .docx

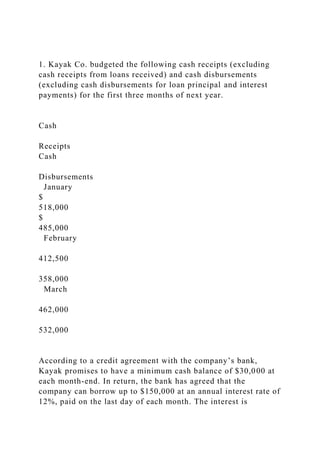

1. Kayak Co. budgeted the following cash receipts (excluding cash receipts from loans received) and cash disbursements (excluding cash disbursements for loan principal and interest payments) for the first three months of next year. Cash Receipts Cash Disbursements January $ 518,000 $ 485,000 February 412,500 358,000 March 462,000 532,000 According to a credit agreement with the company’s bank, Kayak promises to have a minimum cash balance of $30,000 at each month-end. In return, the bank has agreed that the company can borrow up to $150,000 at an annual interest rate of 12%, paid on the last day of each month. The interest is computed based on the beginning balance of the loan for the month. The company repays principal on the loan with available cash on the last day of each month. The company has a cash balance of $30,000 and a loan balance of $60,000 at January 1. Prepare monthly cash budgets for each of the first three months of next year. (Amounts to be deducted should be indicated by a minus sign.) 2. Walker Company prepares monthly budgets. The current budget plans for a September ending inventory of 38,000 units. Company policy is to end each month with merchandise inventory equal to a specified percent of budgeted sales for the following month. Budgeted sales and merchandise purchases for the next three months follow. Sales (Units) Purchases (Units) July 160,000 194,000 August 330,000 324,000 September 300,000 278,000 3. Use the following information to prepare the July cash budget for Acco Co. It should show expected cash receipts and cash disbursements for the month and the cash balance expected on July 31. a. Beginning cash balance on July 1: $64,000. b. Cash receipts from sales: 35% is collected in the month of sale, 50% in the next month, and 15% in the second month after sale (uncollectible accounts are negligible and can be ignored). Sales amounts are: May (actual), $1,750,000; June (actual), $1,480,000; and July (budgeted), $1,540,000. c. Payments on merchandise purchases: 90% in the month of purchase and 10% in the month following purchase. Purchases amounts are: June (actual), $570,000; and July (budgeted), $450,000. d. Budgeted cash disbursements for salaries in July: $220,000. e. Budgeted depreciation expense for July: $15,000. f. Other cash expenses budgeted for July: $110,000. g. Accrued income taxes due in July: $90,000. h. Bank loan interest due in July: $8,500 1. Calculation of cash receipts from sales collected in May, June, July, July 31 Accounts Rec. 2. Calculation of cash payments for merchandise paid in June, July, July 31 Accounts Rec 4. Following information relates to Acco Co. a. Beginning cash balance on July 1: $40,000. b. Cash receipts from sales: 30% is collected in the month of sale, 50% in the next month, and 20% in the second month after sale (uncollectible accounts are negligible and can be ignored). S ...

Recommandé

Recommandé

Contenu connexe

Similaire à 1. Kayak Co. budgeted the following cash receipts (excluding cash .docx

Similaire à 1. Kayak Co. budgeted the following cash receipts (excluding cash .docx (10)

Plus de jackiewalcutt

Plus de jackiewalcutt (20)

Dernier

Dernier (20)

1. Kayak Co. budgeted the following cash receipts (excluding cash .docx

- 1. 1. Kayak Co. budgeted the following cash receipts (excluding cash receipts from loans received) and cash disbursements (excluding cash disbursements for loan principal and interest payments) for the first three months of next year. Cash Receipts Cash Disbursements January $ 518,000 $ 485,000 February 412,500 358,000 March 462,000 532,000 According to a credit agreement with the company’s bank, Kayak promises to have a minimum cash balance of $30,000 at each month-end. In return, the bank has agreed that the company can borrow up to $150,000 at an annual interest rate of 12%, paid on the last day of each month. The interest is

- 2. computed based on the beginning balance of the loan for the month. The company repays principal on the loan with available cash on the last day of each month. The company has a cash balance of $30,000 and a loan balance of $60,000 at January 1. Prepare monthly cash budgets for each of the first three months of next year. (Amounts to be deducted should be indicated by a minus sign.) 2. Walker Company prepares monthly budgets. The current budget plans for a September ending inventory of 38,000 units. Company policy is to end each month with merchandise inventory equal to a specified percent of budgeted sales for the following month. Budgeted sales and merchandise purchases for the next three months follow. Sales (Units) Purchases (Units) July 160,000 194,000 August 330,000

- 3. 324,000 September 300,000 278,000 3. Use the following information to prepare the July cash budget for Acco Co. It should show expected cash receipts and cash disbursements for the month and the cash balance expected on July 31. a. Beginning cash balance on July 1: $64,000. b. Cash receipts from sales: 35% is collected in the month of sale, 50% in the next month, and 15% in the second month after sale (uncollectible accounts are negligible and can be ignored). Sales amounts are: May (actual), $1,750,000; June (actual), $1,480,000; and July (budgeted), $1,540,000. c. Payments on merchandise purchases: 90% in the month of purchase and 10% in the month following purchase. Purchases amounts are: June (actual), $570,000; and July (budgeted), $450,000. d. Budgeted cash disbursements for salaries in July: $220,000.

- 4. e. Budgeted depreciation expense for July: $15,000. f. Other cash expenses budgeted for July: $110,000. g. Accrued income taxes due in July: $90,000. h. Bank loan interest due in July: $8,500 1. Calculation of cash receipts from sales collected in May, June, July, July 31 Accounts Rec. 2. Calculation of cash payments for merchandise paid in June, July, July 31 Accounts Rec 4. Following information relates to Acco Co. a. Beginning cash balance on July 1: $40,000. b. Cash receipts from sales: 30% is collected in the month of sale, 50% in the next month, and 20% in the second month after sale (uncollectible accounts are negligible and can be ignored). Sales amounts are: May (actual), $1,376,000; June (actual), $960,000; and July (budgeted), $1,120,000. c. Payments on merchandise purchases: 60% in the month of purchase and 40% in the month following purchase. Purchases amounts are: June (actual), $344,000; and July (budgeted), $600,000. d. Budgeted cash disbursements for salaries in July: $168,800. e. Budgeted depreciation expense for July: $9,600.

- 5. f. Other cash expenses budgeted for July: $120,000. g. Accrued income taxes due in July: $80,000 (related to June). h. Bank loan interest paid July 31: $5,280. Additional Information: a. Cost of goods sold is 44% of sales. b. Inventory at the end of June is $64,000 and at the end of July is $171,200. c. Salaries payable on June 30 are $40,000 and are expected to be $32,000 on July 31. d. The equipment account balance is $1,280,000 on July 31. On June 30, the accumulated depreciation on equipment is $224,000. e. The $5,280 cash payment of interest represents the 1% monthly expense on a bank loan of $528,000. f. Income taxes payable on July 31 are $99,456, and the income tax rate applicable to the company is 30%. g. The only other balance sheet accounts are: Common Stock, with a balance of $464,000 on June 30; and Retained Earnings, with a balance of $857,600 on June 30. Prepare a budgeted income statement for the month of July and a budgeted balance sheet for July 31.

- 6. 5. Tempo Company's fixed budget for the first quarter of calendar year 2013 reveals the following. Sales (12,000 units) $ 2,424,000 Cost of goods sold

- 7. Direct materials $ 276,600 Direct labor 515,280 Production supplies 318,360 Plant manager salary 76,600 1,186,840

- 8. Gross profit 1,237,160 Selling expenses Sales commissions 105,600

- 10. Administrative salaries 126,600 Depreciation—office equip. 96,600 Insurance 66,600 Office rent 76,600 366,400

- 11. Income from operations $ 481,080 Prepare flexible budgets that show variable costs per unit, fixed costs, and three different flexible budgets for sales volumes of 10,000, 12,000, and 14,000 units. (Round cost per unit to 2 decimal places.)

- 12. 6. Solitaire Company’s fixed budget performance report for June follows. The $615,000 budgeted expenses include $578,100 variable expenses and $36,900 fixed expenses. Actual expenses include $48,900 fixed expenses. Fixed Budget Actual Results Variances Sales (in units) 8,200 10,600

- 13. Sales (in dollars) $ 820,000 $ 1,060,000 $ 240,000 F Total expenses 615,000 738,000 123,000 U

- 14. Income from operations $ 205,000 $ 322,000 $ 117,000 F Prepare a flexible budget performance report showing any variances between budgeted and actual results. List fixed and variable expenses separately. (Do not round intermediate calculations.)

- 15. 7. Bay City Company’s fixed budget performance report for July follows. The $587,000 budgeted expenses include $400,000 variable expenses and $187,000 fixed expenses. Actual expenses include $177,000 fixed expenses. Fixed Budget Actual Results Variances Sales (in units) 8,000 6,900 Sales (in dollars) $

- 16. 640,000 $ 607,200 $ 32,800 U Total expenses 587,000 551,000 36,000 F Income from operations $ 53,000 $ 56,200 $

- 17. 3,200 U Prepare a flexible budget performance report that shows any variances between budgeted results and actual results. List fixed and variable expenses separately. (Do not round intermediate calculations.)