RBI's Role in Indian Banking System

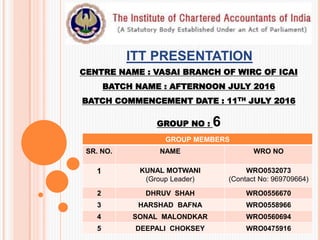

- 1. GROUP MEMBERS SR. NO. NAME WRO NO 1 KUNAL MOTWANI (Group Leader) WRO0532073 (Contact No: 969709664) 2 DHRUV SHAH WRO0556670 3 HARSHAD BAFNA WRO0558966 4 SONAL MALONDKAR WRO0560694 5 DEEPALI CHOKSEY WRO0475916 CENTRE NAME : VASAI BRANCH OF WIRC OF ICAI BATCH NAME : AFTERNOON JULY 2016 BATCH COMMENCEMENT DATE : 11TH JULY 2016 GROUP NO : 6 ITT PRESENTATION

- 3. REASON FOR SELECTING THE TOPIC India is one of the fastest growing economy in the world, with a population over 1.2 Billion housed under the seventh largest nation, India has become the hub for global investment. How does such an economy function? There are various factors that influence & control Indian economy, one such being The RBI, one of the oldest institution behind the success of our economy. Growth in Exports, FOREX, Capital Markets & other Sectors of the economy are all happening because of a strong backbone of Indian economy – The RBI. In this presentation, We will learn about RBI : it’s Function & it’s role in Indian Banking System.

- 4. TOPICS TO BE COVERED IN THE PRESENTATION : INTRODUCTION HISTORY OF RBI ORGANIZATIONAL STRUCTURE OF RBI STRUCTURE OF BANKING IN INDIA ROLE OF RBI IN INDIAN BANKING SYSTEM CONCLUSION

- 5. INTRODUCTION The Reserve Bank of India (RBI) is India's Central banking institution, which controls the monetary policy of the Indian rupee. It is the apex bank in the Indian Banking System. The Preamble of the Reserve Bank of India describes the basic functions of the Reserve Bank as: "...to regulate the issue of Bank Notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage." The Reserve Bank of India has four zonal offices at : 1. Chennai 2. Delhi 3. Kolkata 4. Mumbai. It has 19 regional offices & 10 sub-offices.

- 6. HISTORY OF RBI It commenced its operations on 1st April 1935 during the British Rule in accordance with the provisions of the Reserve Bank of India Act, 1934 by the recommendation of Hilton-Young Commission. The original share capital was Rupees Five Crores divided into shares of 100 each fully paid, which were initially owned entirely by private shareholders. Following India's independence, the RBI was nationalised on 1st January 1949. Reserve Bank continued to act as the Central Bank for Burma (Myanmar) till Japanese Occupation of Burma (1942–45) and later up to April,1947. After the partition of India, the Reserve Bank served as the central bank of Pakistan up to June 1948 when the State Bank of Pakistan commenced operations.

- 7. ORGANIZATIONAL STRUCTURE OF RBI The Central Board of Directors is the main committee of the RBI. The Government of India appoints the directors for a 4-year term. The Board consists of a Governor, and not more than 4 Deputy Governors, 4 Directors to represent the regional boards, 2 from the Ministry of Finance and 10 other directors from various fields. The bank is headed by the Governor and the post is currently held by economist Raghuram Rajan. There are 4 Deputy Governors, Dr Urjit Patel, R Gandhi, S S Mundra and N S Vishwanathan.

- 9. Central Bank (RBI) Scheduled Banks Commercial Banks Public Sector Banks Other Nationalised Banks SBI & Associate Banks Private Sector Banks Foreign Banks Regional Rural Banks Co-operative Banks Urban Co-operative Banks State Co-operative Banks Unscheduled Banks STRUCTURE OF BANKING IN INDIA

- 11. MONETARY AUTHORITY RBI controls the supply of money in the economy by its control over interest rates in order to maintain price stability and achieve high economic growth using Monetary Policy. Main Aim of Monetary Policy is to: 1. Stabilise exchange rate 2. Maintain Healthy Balance of Payment 3. Attain Financial stability 4. Control inflation 5. Strengthen Banking System CONTD....

- 12. MONETARY AUTHORITY (CONTD...) Quantitative Measures of Credit Control under Monetary Policy : Bank Rate : Rate at which RBI discounts bills of commercial banks. Cash Reserve Ratio (CRR) : Portion of Deposit which commercial banks have to keep with RBI in the form of Cash Reserves. Statutory Liquidity Rate (SLR): Portion of Total Deposit which commercial banks have to keep with RBI in the form of Liquid Assets viz – Gold, Cash or Approved Government securities. Repo Rate : Rate at which Commercial Banks borrow money from RBI. Reverse Repo Rate : Rate at which RBI borrows money from Commercial Banks.

- 13. ISSUER OF CURRENCY The bank issues and exchanges currency notes and coins and destroys the same when they are not fit for circulation. The objectives are to issue bank notes and giving public adequate supply of the same, to maintain the currency and credit system of the country to utilize it in its best advantage, and to maintain the reserves. It is the sole authority in India to issue Currency. Every Note issued by RBI has it’s name imprinted on the top along with signature of governor below promissory clause.

- 15. ISSUER OF BANKING LICENSE Every Bank has to obtain a Banking License from RBI to conduct banking business in India (As per Sec 22 of Banking regulation Act) Since April 2014, the RBI has granted 23 new banking licences. Entities / groups in the private sector, entities in public sector and Non-Banking Financial Companies (NBFCs) shall be eligible to set up a bank through a wholly-owned Non-Operative Financial Holding Company (NOFHC). They will also need to have a sound & successful track record of 10 years. Various Banks have been given the license like: Universal Banks Payments Bank Small Finance Banks IDFC Vodafone M- pesa Equitas Holdings Bandhan Bank Fino PayTech Utkarsh Micro Finance

- 16. BANKER’S BANK RBI is bank of all banks in India. As a banker of banks, RBI: Enables smooth and swift clearing and settlements of inter-bank transactions Provides efficient means of funds transfer for all banks Enables banks to maintain their accounts with RBI for statutory reserve requirements and maintenance of transaction balances. Regulates opening of New ATMS & Branches of Commercial Banks Why RBI is called as banker's bank ? 1. Provides loan to banks/bankers. 2. Accept Deposits of Banks. 3. Rediscount the bills of Banks.

- 17. LENDER OF LAST RESORT The banks can borrow from the RBI by keeping eligible securities as collateral or any other arrangement and at the time of need or crisis, they approach RBI for financial help. Thus RBI works as Lender of the Last Resort (LORL) for banks.

- 18. BANKER & DEBT MANAGER OF GOVERNMENT Keeps deposits of Governments (Centre & state) as deposit free of interest. Receives & Makes Payment on behalf of Government. Carrying out the Government’s exchange remittances & other Banking Operations. Helping Both State & Central Government to float new loans and manage public debt. Acts as an Advisor to Government on all monetary & Banking functions

- 19. CONTROLLER OF CREDIT Credit Control is a major weapon used by RBI to control demand & Supply of Money in Economy. Some of the Credit Control techniques are : 1. Open Market Operations (OMO) : An open market operation is an instrument of monetary policy which involves buying or selling of government securities from or to the public and banks. 2. Credit Ceiling : In this operation RBI issues prior information or direction that loans to the commercial banks will be given up to a certain limit. In this case commercial bank will be tight in advancing loans to the public.

- 20. ACTS AS CLEARING HOUSE Clearing Houses facilitate the exchange of instruments and processing of payment instructions at a central point among the participating banks. RBI acts as a Clearing House for settlement of Banking transactions. It is a member bank of the Asian Clearing Union. RBI manages 14 clearing houses of the country situated in different major cities. The SBI & Associate Banks look after clearing house function as an agent of RBI.

- 21. MANAGER OF FOREIGN EXCHANGE RBI is required to maintain external value of Rupee. For this purpose it acts as a custodian of FOREX. On a given day, the foreign exchange rate reflects the demand for and supply of foreign exchange arising from trade and capital transactions. The RBI’s Financial Markets Department (FMD) participates in the foreign exchange market by undertaking sales / purchases of foreign currency to ease volatility in periods of excess demand for/supply of foreign currency. Administer and enforces the provision of Foreign Exchange Management Act (FEMA), 1999.

- 22. SUMMARY The Reserve Bank of India (RBI) is India's Central bank & apex bank in Indian banking system. Commenced business on 1st April 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934. It Plays an important role in strengthening, developing and diversifying the country’s economic & financial structure.

- 23. ROLE OF RBI IN INDIAN BANKING SYSTEM : 1. MONETARY AUTHORITY. 2. ISSUER OF CURRENCY. 3. ISSUER OF BANKING LICENSE. 4. BANKER’S BANK. 5. LENDER OF LAST RESORT. 6. BANKER & DEBT MANAGER OF GOVERNMENT. 7. CONTROLLER OF CREDIT. 8. ACTS AS CLEARING HOUSE. 9. MANAGER OF FOREX SUMMARY (CONTD...)

- 24. BIBLOGRAPHY Chapter on Money & Banking (CA-CPT : Macroeconomics) RBI Official Website (www.rbi.org.in) Economic Times Wikipedia Slideshare.net Google Search Engine