Fundamental Analysis & Financial Analyst Recommandations - Google Inc - US38259P5089 - GOOG UW Equity

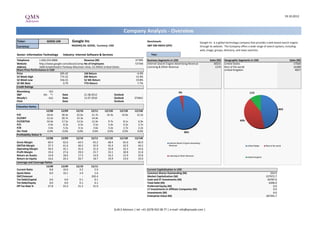

- 1. 19.10.2012 Company Analysis - Overview Ticker: GOOG UW Google Inc Benchmark: Google Inc. is a global technology company that provides a web based search engine Currency: NASDAQ GS: GOOG, Currency: USD S&P 500 INDEX (SPX) through its website. The Company offers a wide range of search options, including web, image, groups, directory, and news searches. Sector: Information Technology Industry: Internet Software & Services Year: Telephone 1-650-253-0000 Revenue (M) 37'905 Business Segments in USD Sales (M) Geographic Segments in USD Sales (M) Website http://www.google.com/about/company/ of Employees No 53'546 Internet Search Engine Advertising Revenue 36531 United States 17560 Address 1600 Amphitheatre Parkway Mountain View, CA 94043 United States Licensing & Other Revenue 1374 Rest of the world 16288 Share Price Performance in USD United Kingdom 4057 Price 695.42 1M Return -4.4% 52 Week High 774.32 6M Return 15.9% 52 Week Low 556.55 52 Wk Return 19.8% 52 Wk Beta 0.79 YTD Return 7.7% Credit Ratings Bloomberg IG2 4% 11% S&P AA- *+ Date 21.08.2012 Outlook - Moody's Aa2 Date 15.07.2010 Outlook STABLE Fitch - Date - Outlook - Valuation Ratios 46% 12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E P/E 18.4x 30.4x 22.6x 21.7x 16.3x 14.0x 12.2x EV/EBIT 12.2x 20.7x 15.3x 14.4x - - - EV/EBITDA 10.0x 17.5x 13.5x 12.4x 9.7x 8.1x 6.9x 43% P/S 4.4x 8.3x 6.5x 5.5x 5.4x 4.2x 3.7x P/B 3.4x 5.5x 4.1x 3.6x 3.2x 2.7x 2.2x Div Yield 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 96% Profitability Ratios % 12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E Gross Margin 60.4 62.6 64.5 65.2 68.4 65.6 66.0 Internet Search Engine Advertising EBITDA Margin 37.3 41.6 40.2 35.9 45.4 42.9 44.2 Revenue United States Rest of the world Operating Margin 30.4 35.1 35.4 31.0 33.8 32.3 33.6 Profit Margin 19.4 27.6 29.0 25.7 33.1 30.8 31.8 Return on Assets 14.8 18.0 17.3 14.9 16.2 15.9 25.8 Licensing & Other Revenue United Kingdom Return on Equity 16.6 20.3 20.7 18.7 19.9 19.0 19.0 Leverage and Coverage Ratios 12/08 12/09 12/10 12/11 Current Ratio 8.8 10.6 4.2 5.9 Current Capitalization in USD Quick Ratio 8.0 10.1 3.9 5.6 Common Shares Outstanding (M) 324.9 EBIT/Interest - - - 202.4 Market Capitalization (M) 227972.7 Tot Debt/Capital 0.0 0.0 0.1 0.1 Cash and ST Investments (M) 46787.0 Tot Debt/Equity 0.0 0.0 0.1 0.1 Total Debt (M) 6206.0 Eff Tax Rate % 27.8 22.2 21.2 21.0 Preferred Equity (M) 0.0 LT Investments in Affiliate Companies (M) 0.0 Investments (M) 0.0 Enterprise Value (M) 187391.7 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. Company Analysis - Analysts Ratings Google Inc Target price in USD Broker Recommendation Buy and Sell Recommendations vs Price and Target Price Price Brokers' Target Price 900 910 1000 900 890 100% 880 880 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 860 850 850 850 850 850 850 840 8% 830 825 820 10% 10% 802 900 795 795 14% 800 780 16% 16% 775 775 18% 18% 18% 18% 765 764 20% 19% 755 750 750 750 731 725 800 695 690 690 675 660 80% 700 700 600 600 60% 500 500 400 90% 93% 90% 86% 400 300 40% 80% 81% 82% 84% 84% 82% 82% 82% 300 200 100 200 20% 0 100 B Riley & BMO Capital Pivotal EVA JPMorgan Morgan S&P Capital Barclays Macquarie BGC Stifel Telsey Raymond Evercore Atlantic Hilliard Lyons RBC Capital Piper Jaffray Daiwa Pacific Crest Argus Edward Credit Credit Suisse Deutsche Needham & Cantor Sanford C. Capstone Nomura SunTrust Jefferies Susquehanna Canaccord Goldman Cowen and Independent Oppenheimer Hamburger William Blair Wedge Wedbush Robert W. Wells Fargo 0% 0 oct.11 nov.11 déc.11 janv.12 févr.12 mars.12 avr.12 mai.12 juin.12 juil.12 août.12 sept.12 Buy Hold Sell Price Target Price Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date 28-Sep-12 82% 18% 0% 19-Oct-12 695.42 801.34 Morgan Stanley SCOTT W DEVITT Overwt/Attractive 764.00 19-Oct-12 31-Aug-12 82% 18% 0% 18-Oct-12 695.42 808.54 JPMorgan DOUGLAS ANMUTH overweight 802.00 19-Oct-12 31-Jul-12 82% 18% 0% 17-Oct-12 755.49 809.40 Raymond James AARON M KESSLER outperform 775.00 19-Oct-12 29-Jun-12 86% 14% 0% 16-Oct-12 744.70 806.22 Nomura BRIAN NOWAK buy 840.00 19-Oct-12 31-May-12 84% 16% 0% 15-Oct-12 740.98 796.36 S&P Capital IQ SCOTT H KESSLER hold 675.00 19-Oct-12 30-Apr-12 84% 16% 0% 12-Oct-12 744.75 791.78 Piper Jaffray EUGENE E MUNSTER overweight 775.00 19-Oct-12 30-Mar-12 82% 18% 0% 11-Oct-12 751.48 786.40 SunTrust Robinson Humphrey SO YOUNG LEE buy 750.00 18-Oct-12 29-Feb-12 81% 19% 0% 10-Oct-12 744.56 779.40 Jefferies BRIAN J PITZ buy 850.00 18-Oct-12 31-Jan-12 80% 20% 0% 9-Oct-12 744.09 777.11 Needham & Co KERRY RICE buy 825.00 18-Oct-12 30-Dec-11 90% 10% 0% 8-Oct-12 757.84 777.11 Pacific Crest Securities EVAN S WILSON outperform 795.00 18-Oct-12 30-Nov-11 93% 8% 0% 5-Oct-12 767.65 774.97 Cantor Fitzgerald YOUSSEF H SQUALI buy 820.00 18-Oct-12 31-Oct-11 90% 10% 0% 4-Oct-12 768.05 774.97 Oppenheimer & Co JASON S HELFSTEIN market perform 765.00 18-Oct-12 3-Oct-12 762.50 774.97 Wells Fargo Securities, LLC JASON MAYNARD market perform 18-Oct-12 2-Oct-12 756.99 773.54 Barclays ANTHONY J DICLEMENTE overweight 750.00 18-Oct-12 1-Oct-12 761.98 773.54 Wedbush JAMES G DIX neutral 690.00 17-Oct-12 28-Sep-12 754.50 773.54 Evercore Partners KEN SENA overweight 860.00 17-Oct-12 27-Sep-12 756.50 773.54 Macquarie BENJAMIN A SCHACHTER outperform 795.00 16-Oct-12 26-Sep-12 753.45 770.40 BGC Partners COLIN W GILLIS hold 690.00 16-Oct-12 25-Sep-12 749.16 763.26 Susquehanna Financial Group HERMAN LEUNG Positive 880.00 16-Oct-12 24-Sep-12 749.38 760.97 Credit Agricole Securities (USA) JAMES LEE buy 900.00 16-Oct-12 21-Sep-12 733.95 755.83 Stifel Nicolaus JORDAN ROHAN hold 15-Oct-12 20-Sep-12 728.10 755.81 Wedge Partners MARTIN PYYKKONEN no rating system 15-Oct-12 19-Sep-12 727.50 744.44 Sanford C. Bernstein & Co CARLOS KIRJNER outperform 850.00 12-Oct-12 18-Sep-12 718.34 744.44 Pivotal Research Group LLC BRIAN WIESER buy 880.00 12-Oct-12 17-Sep-12 709.98 744.06 Credit Suisse STEPHEN JU outperform 850.00 10-Oct-12 14-Sep-12 709.68 744.06 Canaccord Genuity Corp MICHAEL GRAHAM buy 850.00 10-Oct-12 13-Sep-12 706.04 740.64 BMO Capital Markets DANIEL SALMON outperform 830.00 8-Oct-12

- 3. Google Inc Company Analysis - Ownership Ownership Type Ownership Statistics Geographic Ownership Distribution Geographic Ownership 0% Shares Outstanding (M) 324.9 12% United States 83.06% 1% 1% 5% Float 99.6% Britain 4.93% 1% Short Interest (M) 4.8 Canada 2.00% 1% 2% Short Interest as % of Float 1.48% Japan 1.48% 5% Days to Cover Shorts 1.18 Germany 1.25% Institutional Ownership 87.47% Luxembourg 1.05% Retail Ownership 12.20% Switzerland 0.93% Insider Ownership 0.34% Others 5.31% Institutional Ownership Distribution 84% 88% Investment Advisor 84.44% Hedge Fund Manager 8.16% Pension Fund (Erisa) 2.79% Institutional Ownership Retail Ownership Insider Ownership Mutual Fund Manager 1.32% United States Britain Canada Japan Pricing data is in USD Others 3.28% Germany Luxembourg Switzerland Others Top 20 Owners: TOP 20 ALL Institutional Ownership Holder Name Position Position Change Market Value % of Ownership Report Date Source Country FIDELITY MANAGEMENT 13'998'105 1'029'480 9'734'562'179 5.34% 30.06.2012 13F UNITED STATES 1% 3% VANGUARD GROUP INC 11'000'190 337'807 7'649'752'130 4.20% 30.06.2012 13F UNITED STATES 3% STATE STREET CORP 10'237'398 738'119 7'119'291'317 3.91% 30.06.2012 13F UNITED STATES 8% T ROWE PRICE ASSOCIA 9'315'156 -91'244 6'477'945'786 3.56% 30.06.2012 13F UNITED STATES BLACKROCK INSTITUTIO 7'069'157 217'457 4'916'033'161 2.70% 30.06.2012 13F UNITED STATES CAPITAL WORLD INVEST 5'463'186 -935'960 3'799'208'808 2.09% 30.06.2012 13F UNITED STATES BANK OF NEW YORK MEL 4'559'855 478'921 3'171'014'364 1.74% 30.09.2012 13F UNITED STATES INVESCO LTD 4'253'814 -178'622 2'958'187'332 1.62% 30.06.2012 13F UNITED STATES NORTHERN TRUST CORPO 3'718'416 355'178 2'585'860'855 1.42% 30.06.2012 13F UNITED STATES JP MORGAN CHASE & CO 3'289'767 131'799 2'287'769'767 1.26% 30.06.2012 13F UNITED STATES 85% PRIMECAP MANAGEMENT 3'256'315 -113'218 2'264'506'577 1.24% 30.06.2012 13F UNITED STATES DAVIS SELECTED ADVIS 2'816'233 227'830 1'958'464'753 1.08% 30.06.2012 13F UNITED STATES GOLDMAN SACHS GROUP 2'467'848 171'530 1'716'190'856 0.94% 30.06.2012 13F UNITED STATES SANDS CAPITAL MANAGE 2'428'364 219'500 1'688'732'893 0.93% 30.06.2012 13F UNITED STATES Investment Advisor Hedge Fund Manager Pension Fund (Erisa) Mutual Fund Manager Others TIAA CREF INVESTMENT 2'409'094 -18'492 1'675'332'149 0.92% 30.06.2012 13F UNITED STATES BLACKROCK FUND ADVIS 2'278'306 70'375 1'584'379'559 0.87% 30.06.2012 13F UNITED STATES JENNISON ASSOCIATES 2'045'414 36'224 1'422'421'804 0.78% 30.06.2012 13F UNITED STATES DEUTSCHE BANK AG 1'992'319 667'296 1'385'498'479 0.76% 30.06.2012 13F GERMANY GRANTHAM MAYO VAN OT 1'970'297 11'230 1'370'183'940 0.75% 30.06.2012 13F UNITED STATES BAILLIE GIFFORD AND 1'950'437 13'020 1'356'372'899 0.74% 30.06.2012 13F BRITAIN Top 5 Insiders: Holder Name Position Position Change Market Value % of Ownership Report Date Source KORDESTANI OMID 344'943 239'880'261 0.13% 09.03.2009 Form 4 SHRIRAM KAVITARK RAM 237'677 -24'974 165'285'339 0.09% 04.10.2012 Form 4 PAGE LAWRENCE E 80'000 55'633'600 0.03% 11.10.2012 Form 4 SCHMIDT ERIC EMERSON 57'384 39'905'981 0.02% 26.09.2012 Form 4 DOERR L JOHN 38'774 26'964'215 0.02% 01.10.2012 Form 4 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 4. Company Analysis - Financials I/IV Google Inc Financial information is in USD (M) Equivalent Estimates Periodicity: Fiscal Year 12/01 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E Income Statement Revenue 86 440 1'466 3'189 6'139 10'605 16'594 21'796 23'651 29'321 37'905 42'586 53'728 61'090 - Cost of Goods Sold 14 132 626 1'458 2'572 4'225 6'649 8'622 8'844 10'417 13'188 Gross Income 72 308 840 1'732 3'567 6'380 9'945 13'174 14'806 18'904 24'717 29'149 35'259 40'292 - Selling, General & Admin Expenses 61 122 498 890 1'460 2'830 4'861 6'542 6'494 8'523 12'975 (Research & Dev Costs) 17 32 91 226 484 1'229 2'120 2'793 2'843 3'762 5'162 Operating Income 11 186 342 841 2'107 3'550 5'084 6'632 8'312 10'381 11'742 14'380 17'340 20'542 - Interest Expense 2 3 2 1 1 0 1 0 0 0 58 - Foreign Exchange Losses (Gains) 0 0 0 0 0 -5 16 172 260 355 379 - Net Non-Operating Losses (Gains) -1 -1 -6 190 -35 -456 -607 606 -329 -770 -1'021 Pretax Income 10 185 347 650 2'142 4'011 5'674 5'854 8'381 10'796 12'326 15'304 18'207 21'315 - Income Tax Expense 3 85 241 251 676 934 1'470 1'627 1'861 2'291 2'589 Income Before XO Items 7 100 106 399 1'465 3'077 4'204 4'227 6'520 8'505 9'737 - Extraordinary Loss Net of Tax 0 0 0 0 0 0 0 0 0 0 0 - Minority Interests 0 0 0 0 0 0 0 0 0 0 0 Diluted EPS Before XO Items 1.46 5.02 9.94 13.29 13.31 20.41 26.31 29.76 Net Income Adjusted* 7 100 106 684 1'633 2'909 4'204 5'296 6'520 8'505 9'737 14'107 16'546 19'404 EPS Adjusted 0.00 0.00 0.00 2.51 5.70 9.40 13.29 16.68 20.41 26.31 29.76 42.65 49.53 57.24 Dividends Per Share 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Payout Ratio % 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.00 0.00 0.00 Total Shares Outstanding 267 293 309 313 315 318 321 325 Diluted Shares Outstanding 273 292 310 316 318 319 323 327 EBITDA 25 204 393 990 2'401 4'122 6'052 8'132 9'836 11'777 13'593 19'348 23'035 26'981 *Net income excludes extraordinary gains and losses and one-time charges.

- 5. Company Analysis - Financials II/IV Periodicity: 12/01 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E Balance Sheet Total Current Assets 231.796005 560.234009 2693.465 9001 13040 17289 20178 29167 41562 52758 + Cash & Near Cash Items 58 149 427 3'877 3'545 6'082 8'657 10'198 13'630 9'983 + Short Term Investments 89 186 1'705 4'157 7'699 8'137 7'189 14'287 21'345 34'643 + Accounts & Notes Receivable 62 155 312 688 1'322 2'163 2'642 3'178 4'252 5'427 + Inventories 0 0 0 0 0 0 0 0 0 0 + Other Current Assets 23 71 249 279 474 908 1'690 1'504 2'335 2'705 Total Long-Term Assets 55 311 620 1'271 5'434 8'047 11'589 11'330 16'289 19'816 + Long Term Investments 0 0 0 0 1'032 1'060 85 129 523 790 Gross Fixed Assets 87 262 583 1'417 3'290 5'520 7'576 8'130 11'771 14'400 Accumulated Depreciation 33 74 204 456 894 1'481 2'342 3'286 4'012 4'797 + Net Fixed Assets 54 188 379 962 2'395 4'039 5'234 4'845 7'759 9'603 + Other Long Term Assets 1 123 241 309 2'006 2'948 6'270 6'356 8'007 9'423 Total Current Liabilities 90 235 340 745 1'305 2'036 2'302 2'747 9'996 8'913 + Accounts Payable 9 46 33 116 211 282 178 216 483 588 + Short Term Borrowings 4 5 2 0 0 0 0 0 3'465 1'218 + Other Short Term Liabilities 76 185 306 630 1'093 1'753 2'124 2'532 6'048 7'107 Total Long Term Liabilities 10 33 44 107 129 611 1'227 1'745 1'614 5'516 + Long Term Borrowings 7 2 0 0 0 0 0 0 0 2'986 + Other Long Term Borrowings 3 31 44 107 129 611 1'227 1'745 1'614 2'530 Total Liabilities 99 269 384 853 1'434 2'646 3'529 4'493 11'610 14'429 + Long Preferred Equity 58 58 0 0 0 0 0 0 0 0 + Minority Interest 0 0 0 0 0 0 0 0 0 0 + Share Capital & APIC 84 725 2'583 7'478 11'883 13'242 14'451 15'817 18'235 20'264 + Retained Earnings & Other Equity 46 -181 346 1'941 5'157 9'448 13'788 20'187 28'006 37'881 Total Shareholders Equity 188 603 2'929 9'419 17'040 22'690 28'239 36'004 46'241 58'145 Total Liabilities & Equity 287 871 3'313 10'272 18'473 25'336 31'768 40'497 57'851 72'574 Book Value Per Share 10.97 32.14 55.15 72.51 89.61 113.30 143.92 178.97 215.91 259.19 314.49 Tangible Book Value Per Share 9.98 30.91 47.90 64.05 71.09 95.44 121.20 151.50

- 6. Company Analysis - Financials III/IV Periodicity: 12/01 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E Cash Flows Net Income 7 100 106 399 1'465 3'077 4'204 4'227 6'520 8'505 9'737 11'974 14'265 16'695 + Depreciation & Amortization 14 18 50 148 294 572 968 1'500 1'524 1'396 1'851 + Other Non-Cash Adjustments 12 33 246 683 656 28 285 1'799 785 1'279 2'347 + Changes in Non-Cash Capital -2 5 -6 -253 44 -97 319 327 486 -99 630 Cash From Operating Activities 31 155 395 977 2'459 3'581 5'775 7'853 9'316 11'081 14'565 + Disposal of Fixed Assets 0 0 0 0 0 0 0 0 0 0 0 + Capital Expenditures -13 -37 -177 -319 -838 -1'903 -2'403 -2'358 -810 -4'018 -3'438 -3'309 -3'899 -4'292 + Increase in Investments 0 0 0 0 0 0 0 0 0 0 0 + Decrease in Investments 0 0 0 0 0 0 0 0 0 0 0 + Other Investing Activities -16 -73 -137 -1'582 -2'520 -4'996 -1'279 -2'961 -7'209 -6'662 -15'603 Cash From Investing Activities -29 -110 -314 -1'901 -3'358 -6'899 -3'682 -5'319 -8'019 -10'680 -19'041 + Dividends Paid 0 0 0 0 0 0 0 0 0 0 0 + Change in Short Term Borrowings 0 0 0 0 0 0 0 0 0 3'463 726 + Increase in Long Term Borrowings 0 0 0 0 0 0 0 0 0 0 + Decrease in Long Term Borrowings -5 -8 -7 -5 -1 0 0 0 0 0 0 + Increase in Capital Stocks 2 2 15 1'195 4'372 2'966 403 88 233 94 86 + Decrease in Capital Stocks 0 0 0 0 0 0 0 0 0 -801 0 + Other Financing Activities 0 0 2 12 -22 20 40 -46 11 275 17 Cash From Financing Activities -2 -5 10 1'202 4'349 2'986 443 42 244 3'031 829 Net Changes in Cash -0 40 91 278 3'450 -333 2'537 2'575 1'541 3'432 -3'647 Free Cash Flow (CFO-CAPEX) 18 118 219 658 1'621 1'678 3'373 5'494 8'506 7'063 11'127 12'613 14'912 17'003 Free Cash Flow To Firm 19 119 219 659 1'622 1'678 3'373 5'494 8'506 7'063 11'173 Free Cash Flow To Equity 211 595 1'620 1'678 3'373 5'494 8'506 10'526 11'853 Free Cash Flow per Share 3.41 5.88 5.57 10.85 17.50 26.90 22.16 34.47

- 7. Company Analysis - Financials IV/IV Periodicity: 12/01 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E Ratio Analysis Valuation Ratios Price Earnings 76.8x 72.8x 49.0x 52.0x 18.4x 30.4x 22.6x 21.7x 16.3x 14.0x 12.2x EV to EBIT 61.0x 54.7x 36.6x 39.6x 12.2x 20.7x 15.3x 14.4x EV to EBITDA 51.9x 48.0x 31.5x 33.2x 10.0x 17.5x 13.5x 12.4x 9.7x 8.1x 6.9x Price to Sales 11.7x 18.6x 13.1x 13.0x 4.4x 8.3x 6.5x 5.5x 5.4x 4.2x 3.7x Price to Book 17.6x 12.9x 8.4x 9.5x 3.4x 5.5x 4.1x 3.6x 3.2x 2.7x 2.2x Dividend Yield 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Profitability Ratios Gross Margin 83.5% 70.1% 57.3% 54.3% 58.1% 60.2% 59.9% 60.4% 62.6% 64.5% 65.2% 68.4% 65.6% 66.0% EBITDA Margin 29.1% 46.5% 26.8% 31.0% 39.1% 38.9% 36.5% 37.3% 41.6% 40.2% 35.9% 45.4% 42.9% 44.2% Operating Margin 12.7% 42.4% 23.4% 26.4% 34.3% 33.5% 30.6% 30.4% 35.1% 35.4% 31.0% 33.8% 32.3% 33.6% Profit Margin 8.1% 22.7% 7.2% 12.5% 23.9% 29.0% 25.3% 19.4% 27.6% 29.0% 25.7% 33.1% 30.8% 31.8% Return on Assets 18.2% 19.1% 21.6% 21.4% 19.2% 14.8% 18.0% 17.3% 14.9% 16.2% 15.9% 25.8% Return on Equity 31.3% 23.0% 23.7% 23.3% 21.2% 16.6% 20.3% 20.7% 18.7% 19.9% 19.0% 19.0% Leverage & Coverage Ratios Current Ratio 2.59 2.38 7.91 12.08 10.00 8.49 8.77 10.62 4.16 5.92 Quick Ratio 2.33 2.08 7.18 11.70 9.63 8.05 8.03 10.07 3.92 5.62 Interest Coverage Ratio (EBIT/I) 6.24 72.55 177.35 975.86 2715.56 13813.21 4226.43 202.45 Tot Debt/Capital 0.05 0.01 0.00 0.00 0.00 0.00 0.00 0.00 0.07 0.07 Tot Debt/Equity 0.06 0.01 0.00 0.00 0.00 0.00 0.00 0.00 0.07 0.07 Others Asset Turnover 2.53 1.52 0.90 0.74 0.76 0.76 0.65 0.60 0.58 Accounts Receivable Turnover 13.53 13.67 12.28 10.55 9.52 9.07 8.13 7.89 7.83 Accounts Payable Turnover 22.53 36.97 34.69 25.86 26.96 37.48 44.91 29.81 24.63 Inventory Turnover Effective Tax Rate 30.6% 46.1% 69.5% 38.6% 31.6% 23.3% 25.9% 27.8% 22.2% 21.2% 21.0%

- 8. Company Analysis - Peers Comparision TIME WARNER BAIDU INC-SP DAUM AMAZON.COM GOOGLE INC-CL A YAHOO! INC MICROSOFT CORP APPLE INC FACEBOOK INC-A NETEASE INC-ADR SOHU.COM INC VALUECLICK INC EBAY INC BLUCORA INC LOOKSMART LTD INC ADR COMMUNICATI INC Latest Fiscal Year: 12/2011 12/2011 06/2012 09/2011 12/2011 12/2011 12/2011 12/2011 12/2011 12/2011 12/2011 12/2011 12/2011 12/2011 12/2011 52-Week High 774.32 16.79 32.95 705.07 45.00 46.59 154.15 65.54 69.48 152'000.00 21.86 50.94 264.11 18.63 1.50 52-Week High Date 05.10.2012 19.10.2011 16.03.2012 21.09.2012 18.05.2012 09.10.2012 27.03.2012 07.06.2012 28.10.2011 19.10.2011 01.05.2012 18.10.2012 14.09.2012 02.10.2012 19.01.2012 52-Week Low 556.55 14.35 24.30 363.32 17.55 32.09 99.71 40.69 33.75 91'000.00 13.80 28.15 166.97 8.23 0.53 52-Week Low Date 14.06.2012 06.03.2012 25.11.2011 25.11.2011 04.09.2012 25.11.2011 17.07.2012 25.11.2011 23.07.2012 04.06.2012 28.06.2012 25.11.2011 29.12.2011 28.10.2011 18.05.2012 Daily Volume 3'349'983 26'362'626 59'238'423 17'022'216 52'157'366 3'829'717 5'349'480 403'857 277'598 270'909 531'474 34'945'364 5'305'942 421'863 9'400 Current Price (10/dd/yy) 695.42 16.00 29.50 644.61 18.98 45.88 113.18 52.61 39.31 94'500.00 17.13 50.83 244.85 17.68 0.80 52-Week High % Change -10.2% -4.7% -10.5% -10.3% -57.8% -1.5% -26.6% -19.7% -43.4% -37.8% -21.6% -0.2% -7.3% -5.1% -46.7% 52-Week Low % Change 25.0% 11.5% 21.4% 74.1% 8.1% 43.0% 13.5% 29.3% 16.5% 3.8% 24.1% 80.6% 46.6% 114.8% 52.2% Total Common Shares (M) 324.9 1'190.0 8'381.0 929.3 1'330.0 974.0 349.1 131.0 38.1 13.5 80.1 1'286.5 455.0 39.5 17.3 Market Capitalization 227'972.7 18'953.9 248'243.6 593'040.6 45'831.6 43'536.6 39'545.0 6'875.1 1'493.5 1'275'847.3 1'286.3 65'503.1 110'688.2 714.4 13.8 Total Debt 4'204.0 41.0 11'944.0 - 677.0 19'524.0 2'497.7 - 35.8 - 167.5 2'089.6 2'299.0 - 0.8 Preferred Stock - - - - 615.0 - - - - - - - - - - Minority Interest - 40.3 - - - (3.0) 1'033.8 (4.5) 210.6 - - - - - - Cash and Equivalents 45'416.0 2'529.9 63'040.0 81'570.0 3'908.0 3'476.0 14'179.1 2'051.7 829.5 190'671.6 116.7 5'929.4 9'576.0 293.6 24.8 Enterprise Value 187'391.7 16'596.1 193'549.6 475'819.5 36'349.6 60'945.6 232'433.2 4'662.0 874.8 1'102'524.6 1'370.7 60'886.1 108'103.2 646.9 - Valuation Total Revenue LFY 37'905.0 4'984.2 73'723.0 108'249.0 3'711.0 28'974.0 14'500.8 1'158.4 852.1 418'717.6 560.2 11'651.7 48'077.0 228.8 27.6 LTM 47'544.0 4'979.8 72'359.0 148'812.0 3'711.0 28'984.0 18'369.5 1'261.5 961.3 418'717.6 632.4 13'459.0 54'326.0 339.5 20.2 CY+1 42'586.1 4'421.3 80'044.5 156'526.5 4'906.8 29'040.3 22'167.5 1'338.3 1'044.1 537'286.0 681.5 14'106.5 62'775.4 404.4 - CY+2 53'727.8 4'504.9 85'902.3 193'271.8 6'294.6 30'147.2 31'023.9 1'550.7 1'239.3 663'392.0 756.9 16'223.3 80'698.6 457.6 - EV/Total Revenue LFY 4.1x 3.3x 2.7x 4.0x - 1.9x 16.6x 4.6x 1.3x 3.4x 2.3x 5.0x 2.1x 1.9x - LTM 3.3x 3.3x 2.7x 2.9x - 1.9x 13.1x 4.4x 1.1x 3.4x 2.1x 4.3x 1.9x 1.3x - CY+1 4.3x 3.7x 2.2x 3.0x 7.8x 2.0x 10.6x 4.1x 0.9x 2.1x 1.8x 4.3x 1.6x - - CY+2 3.3x 3.5x 1.9x 2.2x 5.8x 1.9x 7.2x 3.2x 0.6x 1.6x 1.4x 3.7x 1.3x - - EBITDA LFY 13'593.0 1'473.0 30'923.0 35'604.0 2'079.0 6'877.0 8'461.6 574.6 351.7 143'627.2 160.4 3'313.0 1'945.0 28.9 (0.2) LTM 15'347.0 1'420.4 29'012.0 55'846.0 2'079.0 6'836.0 - 614.7 343.1 143'627.2 177.2 3'922.7 2'217.0 63.6 (4.3) CY+1 19'347.7 1'505.0 33'886.1 58'774.6 2'594.7 6'904.8 12'419.7 652.3 251.8 199'022.0 213.0 4'628.4 3'131.2 85.1 - CY+2 23'035.0 1'642.3 36'498.4 71'921.3 3'482.4 7'355.2 16'929.8 753.2 333.4 270'454.0 237.2 5'351.8 4'526.2 101.4 - EV/EBITDA LFY 11.6x 11.2x 6.3x 12.1x - 7.8x 28.4x 9.4x 3.1x 9.9x 8.2x 17.4x 51.7x 14.8x - LTM 10.2x 11.6x 6.8x 7.7x - 7.9x - 8.8x 3.1x 9.9x 7.4x 14.7x 45.4x 6.8x - CY+1 9.4x 10.8x 5.3x 7.9x 14.7x 8.5x 18.8x 8.5x 3.6x 5.6x 5.8x 13.2x 32.9x - - CY+2 7.7x 9.7x 4.4x 5.9x 10.5x 7.9x 13.2x 6.6x 2.3x 4.0x 4.6x 11.1x 22.3x - - EPS LFY 29.76 0.84 2.74 27.68 0.46 2.95 18.99 3.92 4.39 8'367.75 1.24 1.76 1.37 0.85 -0.13 LTM 33.07 0.94 2.59 42.54 0.46 2.93 24.49 4.27 3.14 7'846.00 1.33 2.04 0.90 1.16 -0.38 CY+1 42.65 1.01 2.98 44.39 0.48 3.19 29.50 4.57 2.08 7'416.04 1.65 2.35 2.04 0.96 - CY+2 49.53 1.13 3.29 53.02 0.62 3.65 38.96 5.17 3.44 9'228.10 1.77 2.74 3.88 1.23 - P/E LFY 21.0x 17.0x 11.4x 14.9x 41.3x 15.7x 28.9x 12.3x 12.5x 12.0x 12.9x 24.9x 272.1x 15.2x - LTM 21.0x 17.0x 11.4x 14.9x 41.3x 15.7x 28.9x 12.3x 12.5x 11.3x 12.9x 24.9x 272.1x 15.2x - CY+1 16.3x 15.8x 9.9x 14.3x 39.3x 14.4x 24.0x 11.5x 18.9x 12.7x 10.4x 21.6x 120.0x 18.4x - CY+2 14.0x 14.2x 9.0x 11.9x 30.7x 12.6x 18.2x 10.2x 11.4x 10.2x 9.7x 18.5x 63.2x 14.3x - Revenue Growth 1 Year 29.3% (21.2%) 5.4% 66.0% 88.0% 7.8% 83.2% 38.8% 39.1% 21.2% 30.0% 27.3% 40.6% 6.8% (41.8%) 5 Year 27.9% (5.8%) 4.0% 46.1% - (7.8%) 69.9% 37.0% 53.2% 17.0% 4.5% 13.0% 35.4% 28.8% (18.5%) EBITDA Growth 1 Year 15.4% (2.6%) 3.3% 83.4% 77.5% 7.2% 92.3% 36.6% 36.9% 17.8% 36.8% 16.8% (1.5%) 56.0% - 5 Year 27.0% (0.1%) 9.1% 67.8% - (17.0%) 90.9% 26.9% 59.0% 21.2% 3.8% 11.0% 26.8% 5.0% - EBITDA Margin LTM 35.9% 29.6% 41.9% 32.9% 56.0% 23.7% 58.4% 49.6% 41.3% 34.3% 28.6% 28.4% 4.0% 12.6% (0.7%) CY+1 45.4% 34.0% 42.3% 37.5% 52.9% 23.8% 56.0% 48.7% 24.1% 37.0% 31.3% 32.8% 5.0% 21.1% - CY+2 42.9% 36.5% 42.5% 37.2% 55.3% 24.4% 54.6% 48.6% 26.9% 40.8% 31.3% 33.0% 5.6% 22.2% - Leverage/Coverage Ratios Total Debt / Equity % 7.2% 0.3% 18.0% 0.0% 15.8% 65.2% 16.3% 0.0% 3.4% 0.0% 29.7% 11.7% 29.6% 0.0% 3.2% Total Debt / Capital % 6.7% 0.3% 15.3% 0.0% 12.1% 39.5% 13.3% 0.0% 2.7% 0.0% 22.9% 10.4% 22.9% 0.0% 3.1% Total Debt / EBITDA 0.309x 0.028x 0.386x 0.000x 0.326x 2.839x 0.295x 0.000x 0.102x 0.000x 1.044x 0.631x 1.182x 0.000x - Net Debt / EBITDA -3.032x -1.690x -1.652x -2.291x -1.554x 2.334x -1.381x -3.570x -2.257x -1.367x 0.317x -1.159x -3.741x -10.145x - EBITDA / Int. Expense 234.362x - 81.376x - 49.500x 5.206x - - - 18799.366x - 132.359x 29.923x - -2.222x Credit Ratings S&P LT Credit Rating AA- *+ NR AAA NR - BBB - - - - - A NR - - S&P LT Credit Rating Date 21.08.2012 18.04.2008 22.09.2008 16.04.2004 - 27.03.2009 - - - - - 02.03.2010 07.12.2011 - - Moody's LT Credit Rating Aa2 - Aaa WR - Baa2 - - - - - A2 WR - - Moody's LT Credit Rating Date 16.05.2011 - 11.05.2009 31.03.2004 - 06.03.2006 - - - - - 21.10.2010 28.05.2003 - -