Signaler

Partager

Recommandé

Recommandé

Contenu connexe

Tendances

Tendances (20)

Money Laundering and Terrorist Financing in a Nutshell: Chapter One

Money Laundering and Terrorist Financing in a Nutshell: Chapter One

E-book: How to manage Anti-Money Laundering and Counter Financing of Terroris...

E-book: How to manage Anti-Money Laundering and Counter Financing of Terroris...

How to Improve Anti-Money Laundering Investigation using Neo4j

How to Improve Anti-Money Laundering Investigation using Neo4j

Similaire à Anti Money Laundering

Similaire à Anti Money Laundering (20)

Plus de Taha Khan

Plus de Taha Khan (20)

Dernier

Making communications land - Are they received and understood as intended? webinar

Thursday 2 May 2024

A joint webinar created by the APM Enabling Change and APM People Interest Networks, this is the third of our three part series on Making Communications Land.

presented by

Ian Cribbes, Director, IMC&T Ltd

@cribbesheet

The link to the write up page and resources of this webinar:

https://www.apm.org.uk/news/making-communications-land-are-they-received-and-understood-as-intended-webinar/

Content description:

How do we ensure that what we have communicated was received and understood as we intended and how do we course correct if it has not.Making communications land - Are they received and understood as intended? we...

Making communications land - Are they received and understood as intended? we...Association for Project Management

Mehran University Newsletter is a Quarterly Publication from Public Relations OfficeMehran University Newsletter Vol-X, Issue-I, 2024

Mehran University Newsletter Vol-X, Issue-I, 2024Mehran University of Engineering & Technology, Jamshoro

Dernier (20)

Making communications land - Are they received and understood as intended? we...

Making communications land - Are they received and understood as intended? we...

On National Teacher Day, meet the 2024-25 Kenan Fellows

On National Teacher Day, meet the 2024-25 Kenan Fellows

Interdisciplinary_Insights_Data_Collection_Methods.pptx

Interdisciplinary_Insights_Data_Collection_Methods.pptx

Fostering Friendships - Enhancing Social Bonds in the Classroom

Fostering Friendships - Enhancing Social Bonds in the Classroom

Sensory_Experience_and_Emotional_Resonance_in_Gabriel_Okaras_The_Piano_and_Th...

Sensory_Experience_and_Emotional_Resonance_in_Gabriel_Okaras_The_Piano_and_Th...

Unit-V; Pricing (Pharma Marketing Management).pptx

Unit-V; Pricing (Pharma Marketing Management).pptx

Micro-Scholarship, What it is, How can it help me.pdf

Micro-Scholarship, What it is, How can it help me.pdf

Kodo Millet PPT made by Ghanshyam bairwa college of Agriculture kumher bhara...

Kodo Millet PPT made by Ghanshyam bairwa college of Agriculture kumher bhara...

Unit 3 Emotional Intelligence and Spiritual Intelligence.pdf

Unit 3 Emotional Intelligence and Spiritual Intelligence.pdf

Anti Money Laundering

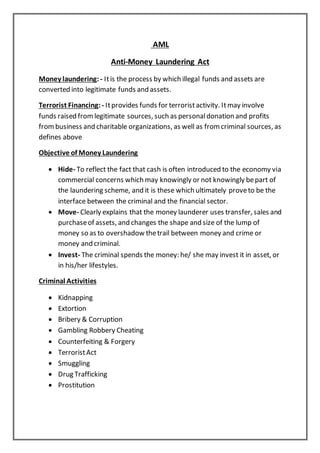

- 1. AML Anti-Money Laundering Act Money laundering:- Itis the process by which illegal funds and assets are converted into legitimate funds and assets. Terrorist Financing:- Itprovides funds for terroristactivity. Itmay involve funds raised from legitimate sources, such as personaldonation and profits frombusiness and charitable organizations, as well as from criminal sources, as defines above Objective of Money Laundering Hide- To reflect the fact that cash is often introduced to the economy via commercial concerns which may knowingly or not knowingly bepart of the laundering scheme, and it is these which ultimately proveto be the interface between the criminal and the financial sector. Move- Clearly explains that the money launderer uses transfer, sales and purchaseof assets, and changes the shape and size of the lump of money so as to overshadow thetrail between money and crime or money and criminal. Invest- The criminal spends the money: he/ she may invest it in asset, or in his/her lifestyles. Criminal Activities Kidnapping Extortion Bribery & Corruption Gambling Robbery Cheating Counterfeiting & Forgery TerroristAct Smuggling Drug Trafficking Prostitution

- 2. Stages of Money Laundering Placement: - To push the dirty Money into the clean system through series of small banking transaction, so to avoid suspicions. Layering: - To disguisethe origin of funds for funding the property, multiple accounts in different name setup. Objectiveis to hide the audit trail of the transactions. Integration:- To use the legitimate money (proceeds from options) for conducting legitimate transactions (buying property) AML Stages Decode Placement o Depositing smaller cash amounts in one or severalaccounts o Purchasing cheques and then depositing the same into the bank o Purchasing singlepremium insurancepolicy withoutpaying attention to details and conditions for cancellation and commissions o Money smuggling over borders o Buying precious/Valuable metals Layering o Buying shares and then reselling the same o Issuing severalcomplexbank transfer o Issuing transfersagainstgoods o Debt repayment Integration o Repurchasing precious valuable assets, properties, lands o Entering into or financing business projects o Buying Goods o Buying bonds, equity etc. Money laundering Techniques Bulk cash smuggling: - Itinvolves literally smuggling cash into another country for deposit into offshorebanks or other type of financial institution that client secrecy.

- 3. Structuring: - Italso referred to as “smurfing” is a method in which cash is broken down smaller amount, which are then used to purchasemoney order or other instruments to avoid detection or suspicion. Cash-intensivebusiness: - Itoccurs when a business that legitimately Deals with large amounts of cash uses its accounts to deposit money obtained fromboth everyday business proceeds and money obtained through illegal means. Trade-basedLaundering: - Itis in which invoices are altered to show a higher or lower amount in order to mask the movement of money. Shell companies: - Shell companies and trusts are used to disguisethe true owner or agent of a large amount of money. Bank capture: - Itrefers to the useof a bank owned by money launderers or criminals, who then funds through the bank without fear of investigation. Real estate laundering: - Itoccurs when someonepurchases realestate with money obtained illegally, then sells the property. This makes it seems as if the profits are legitimate. Causes of Money Laundering Absence of Money Laundering Evasionof Tax Increase inProfits To make black money appear white money Limitedrisks of exposure PMLA (Preventionof money laundering act) 2002 Itis an act to preventmoney laundering and there causes and to punish those who commit the offence of money laundering. As per section 48 & 49 of the PMLA the officers of the directorate of enforcement have been given powers to investigate cases of money laundering. The officers havealso been authorised to initiate proceeding for attachment of property and to launch prosecution in the designated special court for the offence of money laundering.

- 4. FATF (Financial ActionTask Force) 1989 Itwas formed in 1989 by a coalition of countries. This intergovernmental agency was designed to develop and promote international cooperation for combating money laundering. As of 2015 the FAFTis comprised of 34 different countries , but the agency is always seeking to expand its membership to more regions. Headquarter in Paris, France; the FAFTalso works to combat the financing of terrorism. Itmonitoring the progress of member countries in their anti-money laundering measures. Reviewing trends and techniques in money laundering, reporting these, as well as new counter measures, to member countries Promoting FAFTanti-money laundering measures and standards globally.