Nifty Trades in A Narrow Range A Day Ahead Of RBI Credit Policy

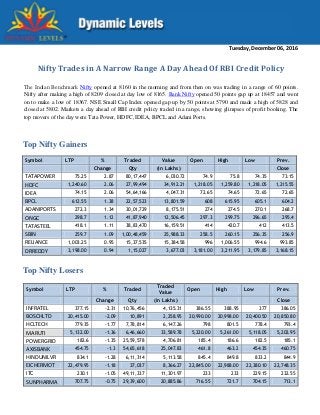

- 1. Tuesday, December 06, 2016 Top Nifty Gainers Symbol LTP % Traded Value Open High Low Prev. Change Qty (in Lakhs) Close TATAPOWER 75.25 2.87 80,17,447 6,030.72 74.9 75.8 74.35 73.15 HDFC 1,240.60 2.06 27,99,494 34,912.21 1,218.05 1,259.80 1,218.05 1,215.55 IDEA 74.15 2.06 54,64,166 4,047.31 72.65 74.65 72.65 72.65 BPCL 612.55 1.38 22,57,523 13,801.59 608 615.95 605.1 604.2 ADANIPORTS 272.3 1.34 30,01,729 8,175.51 274 274.5 270.1 268.7 ONGC 298.7 1.12 41,87,940 12,506.45 297.3 299.75 296.65 295.4 TATASTEEL 418.1 1.11 38,83,470 16,159.51 414 420.7 412 413.5 SBIN 259.7 1.09 1,00,48,459 25,988.33 258.5 260.15 256.35 256.9 RELIANCE 1,003.25 0.95 15,37,535 15,384.58 996 1,006.55 994.6 993.85 DRREDDY 3,198.00 0.94 1,15,027 3,677.03 3,181.00 3,211.95 3,179.85 3,168.15 Top Nifty Losers Symbol LTP % Traded Traded Value Open High Low Prev. Change Qty (in Lakhs) Close INFRATEL 377.15 -2.31 10,76,456 4,135.31 386.55 388.95 377 386.05 BOSCHLTD 20,415.00 -2.09 10,891 2,258.95 20,990.00 20,998.00 20,400.50 20,850.80 HCLTECH 779.35 -1.77 7,78,814 6,147.26 798 801.5 778.4 793.4 MARUTI 5,132.00 -1.36 6,46,660 33,589.78 5,220.00 5,261.00 5,118.05 5,202.95 POWERGRID 182.6 -1.35 25,59,578 4,706.81 185.4 186.6 182.5 185.1 AXISBANK 454.75 -1.3 54,65,618 25,047.83 461.8 463.2 454.35 460.75 HINDUNILVR 834.1 -1.28 6,11,314 5,113.58 845.4 849.8 833.2 844.9 EICHERMOT 22,479.95 -1.18 37,037 8,366.27 22,845.00 22,988.00 22,380.10 22,748.35 ITC 230.1 -1.05 49,11,337 11,301.97 233 233 229.15 232.55 SUNPHARMA 707.75 -0.75 29,39,600 20,885.86 716.55 721.7 704.15 713.1 Nifty Trades in A Narrow Range A Day Ahead Of RBI Credit Policy The Indian Benchmark Nifty opened at 8160 in the morning and from then on was trading in a range of 60 points. Nifty after making a high of 8209 closed at day low of 8165. Bank Nifty opened 50 points gap up at 18457 and went on to make a low of 18367. NSE Small Cap Index opened gap up by 50 points at 5790 and made a high of 5828 and closed at 5802. Markets a day ahead of RBI credit policy traded in a range, showing glimpses of profit booking. The top movers of the day were Tata Power, HDFC, IDEA, BPCL and Adani Ports.

- 2. A quick View of the Sectors SECTOR % CHANGE TODAY FMCG- PACKAGING 2.53% METALS AND MINING 2.07% DEFENCE 1.88% INFRA- POWER 1.64% FINANCIAL SERVICES 1.62% DIVERSIFIED 1.17% REALTY 1.08% CEMENT 1.02% AUTO- TYRES AND TUBES 0.98% MEDIA- ENTERTAINMENT 0.79% FINANCIAL SERVICES- NBFC 0.76% FOOTWEAR 0.74% INFRA- MACHINERY EQUIPMENT 0.59% AUTO- AUTOMOBILES AND AUTO PARTS 0.56% BANKS-PRIVATE 0.56% IT 0.47% INFRA- CONSTRUCTION ENGINEERING AND MATERIALS 0.39% BANKS-PSU 0.38% ENTERTAINMENT-HOTELS AND LEISURE 0.36% PAPER 0.36% ENERGY-OIL & GAS 0.29% TEXTILES AND APPAREL 0.24% PHARMA 0.24% CHEMICALS 0.22% TRANSPORTATION LOGISTICS 0.21% INFRA- TELECOM 0.20% FMCG- SUGAR 0.17% FERTILISERS 0.12% REALTY- HOUSEHOLD -0.04% FMCG -0.11% FMCG- BREVERAGES -0.13% AUTO-AUTO ANCL AND COMPONENTS -0.30% FMCG- FOOD -0.56% MEDIA -0.73% AIRLINES -0.94% JEWELLERY -1.35% Dynamic Sector Performance – 6th December 2016 Some Indices turned positive while most of them stayed in the red zone. FMCG-Packaging gained the most, followed by Metals and Mining, Defence and Infra-Power. While, Jewellery, Airlines, Media and FMCG - Food lost the most in the day’s trade.

- 3. NSE High Volumes Stock Performer List TOP GAINER TOP LOSER SYMBOL LTP %CHANGESECTOR SYMBOL LTP %CHANGESECTOR RBL 1029.00 15.04AUTO- AUTOMOBILES AND AUTO PARTSVENKEYS 454.95 -9.01FMCG- FOOD TATASPONGE 598.00 13.33METALS AND MINING IGPL 224.00 -4.72CHEMICALS NATIONALUM 61.80 9.96METALS AND MINING EXCELCROP 1755.05 -4.39CHEMICALS ADANITRANS 60.65 9.87INFRA- POWER ADFFOODS 149.90 -3.66FMCG- FOOD JMFINANCIL 70.05 7.60FINANCIAL SERVICES CHEMFALKAL 276.40 -2.98CHEMICALS HEIDELBERG 116.25 5.68CEMENT SATIN 384.20 -2.91FINANCIAL SERVICES RAIN 56.15 5.24CEMENT BIRLACORPN 640.50 -2.48CEMENT TIMETECHNO 96.15 5.14FMCG- PACKAGING SURYAROSNI 194.20 -2.31REALTY- HOUSEHOLD OBEROIRLTY 296.65 4.69REALTY HINDOILEXP 69.95 -2.30ENERGY-OIL & GAS JKTYRE 122.40 4.66AUTO- TYRES AND TUBES KALPATPOWR 238.00 -1.57INFRA- POWER MANAPPURAM 74.15 3.78FINANCIAL SERVICES- NBFC IIFL 264.60 -1.56FINANCIAL SERVICES JAMNAAUTO 177.65 3.74AUTO- AUTOMOBILES AND AUTO PARTSWHIRLPOOL 871.85 -1.42REALTY- HOUSEHOLD ANANTRAJ 42.95 3.62REALTY TFCILTD 51.65 -1.33FINANCIAL SERVICES- NBFC SARDAEN 240.90 3.21METALS AND MINING ORIENTPPR 68.85 -1.22REALTY- HOUSEHOLD CARERATING 1448.95 3.17FINANCIAL SERVICES GEOMETRIC 236.50 -1.19IT NAVINFLUOR 2357.05 2.66CHEMICALS TIRUMALCHM 775.05 -1.15CHEMICALS UFLEX 267.00 2.65FMCG- PACKAGING HERITGFOOD 884.05 -1.14FMCG- FOOD VISAKAIND 198.05 2.40CEMENT BAJAJFINSV 2999.00 -1.08FINANCIAL SERVICES- NBFC SUNDRMFAST 291.05 2.21AUTO-AUTO ANCL AND COMPONENTS CENTURYPLY 167.70 -0.97REALTY- HOUSEHOLD HIKAL 224.80 2.14PHARMA SIMPLEXINF 293.95 -0.96INFRA- CONSTRUCTION ENGINEERING AND MATERIALS MUTHOOTFIN 299.35 2.10FINANCIAL SERVICES- NBFC TUBEINVEST 569.65 -0.93AUTO-AUTO ANCL AND COMPONENTS RAMCOIND 205.35 2.09REALTY- HOUSEHOLD GMDCLTD 98.90 -0.90METALS AND MINING DEEPAKNTR 92.00 2.00CHEMICALS CHOLAFIN 909.90 -0.89FINANCIAL SERVICES- NBFC DELTACORP 109.70 1.95ENTERTAINMENT-HOTELS AND LEISURE CHENNPETRO 265.05 -0.89ENERGY-OIL & GAS HGS 518.00 1.83IT FINPIPE 416.85 -0.77REALTY- HOUSEHOLD DEEPAKFERT 189.00 1.69FERTILISERS SSWL 611.15 -0.76AUTO-AUTO ANCL AND COMPONENTS DCMSHRIRAM 213.25 1.60DIVERSIFIED MEGH 41.30 -0.72CHEMICALS NILKAMAL 1345.60 1.57REALTY- HOUSEHOLD BANCOINDIA 194.30 -0.64AUTO-AUTO ANCL AND COMPONENTS GICHSGFIN 278.50 1.49FINANCIAL SERVICES- NBFC TVSSRICHAK 3360.35 -0.60AUTO- TYRES AND TUBES

- 4. Jubilant Industries Ltd is in the FMCG sector, a Mid Cap company having a market cap of Rs. 353.58 crores as on 6th December 2016. The company operates in the Beverages - Alcoholic sector. It has reported the consolidated sales of Rs. 136.58 crores and a net profit of Rs. 5.03 crores for the quarter ended September 2016. Today, at NSE, Jubilant Industries share price surged over 9% to trade at the new 52 week high of 323.80 and is just a few points away from its lifetime high of Rs. 328.15. In a week the stock has gained almost 7% on the back of its strong fundamentals and has the Beta of 1.56. Jubilant Industries today opened at Rs. 299.80, a tad higher than its previous close of Rs. 296.75. The company has the Debt Equity ratio of 6.20, the Interest coverage ratio of 0.80 and the Current ratio of 2.48. Jubilant Industries Ltd. main Products and Revenue Segments include Indian Made Foreign Liquor (IMFL) which added Rs 39.99 Cr to Sales Value (99.62% of Total Sales), Other Operating Revenue which contributed Rs 0.15 Cr to Sales Value (0.37% of Total Sales), for the year ending 31st Mar 2016. For the Q2Fy17, the company has reported the EPS of 1.09. At 1:18 PM, Jubilant Industries share price was trading at Rs. 313.20, up by 5.54%. So far, over four lakh shares have changed hands on the NSE trading counter. Rane Brake Lining Ltd is in the Auto Ancillaries sector, having a market capitalization of Rs. 707.99 crores as on 6th December 2016. It has posted the sales of Rs. 113.07 crores and a net profit of Rs. 9.83 crores for the quarter ended September 2016. Today, Rane Brake Lining share price surged almost 14% intraday today at NSE and traded at the intraday high of the first half of the trade of Rs. 1018.90. The stock had opened at Rs.883.35, correcting from its previous close of Rs. 894.50. According to the shareholding pattern of the company, Indian promoters hold 46.10% stakes while foreign promoters own 20.40% shares. Institutions and Non-institutions own 9.83% and 23.67% stakes respectively. Jubilant Industries trades at New 52 Week High Today re Price Surges 13% over Q2 Rane Brake Lining Surges 14% Intraday Today re Price Surges 13% over Q2 At 12:23 PM, Rane brake lining share price was trading at Rs. 989, up by 10.56% as compared to the 0.47% rise in the benchmark index Nifty. So far, approximately two lakh shares have changed hands over the NSE trading counter as compared to the twenty day average of sixty two thousand shares.

- 5. Established in the year 2013, Adani Transmission Ltd., is a Mid Cap company whose market cap amounts to Rs 6076.45 Cr. and operates in the Power sector. Adani Transmission Ltd. key Products/Revenue Segments are Caster Oil which provided Rs 148.54 Cr to Sales Value (54.12 per cent of Total Sales), Transmission Lines, Towers & Structures which contributed Rs 125.91 Cr to Sales Value (45.87 per cent of Total Sales), for the year ending 31st Mar 2016. Adani Group's power transmission arm Adani Transmission clocked a standalone net loss of Rs.15 crore for the quarter ended September 30, 2016. Total standalone income from operations is registered at Rs. 192 crore for the quarter as against Rs. 35 crore last year. The company's finance costs have significantly shot up from Rs. 40.53 crore in second quarter last year, hence putting pressure on the profitability of the company's operations. On the consolidated basis, the company posted net profit of Rs. 99 crore in second quarter, 39 per cent down from Rs. 162 crore in the same quarter last year. Total income from operations amounted to Rs. 683 crore for the quarter. Intraday on Tuesday, Adani Transmission share price is currently trading at Rs. 59.80, up by 8 per cent from its previous closing of Rs. 55.20 on the National Stock Exchange. The scrip opened at Rs. 55.85 and has touched a high and low of Rs. 60.35 and Rs. 54.65, respectively. This morning of 6th Dec, Anant Raj share price rolled above 4 per cent. The stock opened with a rise of 1.75 points at Rs. 43 as compared to its previous closing at Rs. 41.45. The stock touched the days high and low at Rs. 44 and Rs. 43. With the next few minutes, around 4,77,354 shares are traded in the counter with a traded value of Rs. 207.70 lacs, as per NSE. The lower price band of the share is 33.20 and the upper price band is 49.70 The 52 week high of Anant Raj share price is observed at Rs. 65.40 on 21st July ’16 whereas the 52 week low is seen at Rs. 27.50 on 26th Feb ‘16. The Average Daily Movement of the stock is 2.10 and its average volume for last 20 days is 689149. The stock yields -17.75 per cent monthly returns and has the PE ratio of 19.06. The market cap of the company amounts to Rs. 1223.17 (Cr) and has a book value of Rs. 141.90. Anant Raj Ltd. was incorporated in the year 1985. It is a Small Cap company which operates in the Construction sector. Anant Raj Ltd. key Products/Revenue Segments include Income From Real Estate Development which contributed Rs 376.70 Cr to Sales Value (92.28 per cent of Total Sales), Rentals & Service Charges which contributed Rs 31.50 Cr to Sales Value (7.71 per cent of Total Sales), for the year ending 31st Mar 2016. Anant Raj Share Price Opened On a Positive Note Adani Transmission surged as much as 8 % Anant Raj is a multibagger stock for this quarter as recognized by Dynamic Levels, based on their technical and fundamental research, it is seen to have traded in very high volumes. Multibagger stocks have a great potential to grow in the long run. In order to know about the support and resistance levels of the scrip and also its fundamentals and financials, please a pay a visit to Anant Raj share price history.

- 6. Hot Picks of the Day SBI’s Merger Plan is in Progress State Bank of India informed that the merger plan of associates with itself is progressing and it will not get delayed because of this high-value currency withdrawal and its aftermath. The merger of five associates and the Bharatiya Mahila Bank (BMB) will be executed by 2016-17 end. Visit page Microfinance Companies untouched from Demon-etization India’s cash-dominated microfinance sector may have been hurt the most by the Modi government’s demonetization move, but sector leaders like Ujjivan Financial Services and Bharat Financial Inclusion are all out to show that all is well. But, industry leaders are not too confident of the sector matching the 84% growth the NBFC- MFI sector recorded last year. This is because MFIs are now lending only to existing borrowers and limiting the number of new borrowers. Read more… Stocks That Gained Over 20% since Cash Crunch After 8.00 pm of November 8, the time of Prime Minister Narendra Modi’s demonetization announcement, there was no doubts that markets were going to take a beating. That came to pass, with some help from the shocking outcome of the US elections. The BSE S&P Sensex fell 5 percent the day after and Nifty declined over 6 percent. Read more…. Are the NBFCs rejoicing a Possible RBI Rate Cut? As the market commenced this morning the financial sector was seen to draw a lot of attention. At 9.30 AM, the Financial Services- NBFC was up by 1.35 per cent. This surge was seen to be a result of the expected Repo rate cut by the RBI in its next meet which is scheduled on 7th December, tomorrow. Read more….

- 7. Disclaimer The investment advice or guidance provided by way of recommendations, reports or other ways are solely the personal views of the research team. Users are advised to use the data for the purpose of information and rely on their own judgment while making investment decision. Dynamic Equities Pvt. Ltd - SEBI Investment Advisory Reg. No.: INA300002022 Disclosure Dynamic Equities Pvt. Ltd. is a member of NSE, BSE, MCX SX and a DP with NSDL & CDSL. It is also engaged in Investment Advisory Services and Portfolio Management Services. Dynamic Commodities Pvt. Ltd., associate company, is a member of MCX & NCDEX. We declare that our activities were neither suspended nor we have defaulted with any stock exchange authority with whom we are registered. SEBI, Exchanges and Depositories have conducted the routine inspection and based on their observations have issued advise letters or levied minor penalty on for certain operational deviations. Answers to the Best of our knowledge and belief of Dynamic/ its Associates/ Research Analyst: DYNAMIC/its Associates/ Research Analyst/ his Relative: Do not have any financial interest / any actual/beneficial ownership in the subject company. Do not have any other material conflict of interest at the time of publication of the research report Have not received any compensation from the subject company in the past twelve months Have not managed or co-managed public offering of securities for the subject company. Have not received any compensation for brokerage services or any products / services or any compensation or other benefits from the subject company, nor engaged in market making activity for the subject company Have not served as an officer, director or employee of the subject company Report Prepared By: Mayank Jain - NISM-201500086427 Vikash Kandoi - NISM-201500086430