Summary of Ratio Analyses

•Télécharger en tant que PPTX, PDF•

4 j'aime•1,342 vues

Financial Analysis

Signaler

Partager

Signaler

Partager

Recommandé

Recommandé

Contenu connexe

Tendances

Tendances (20)

International financial management ppt @ bec doms bagalkot mba finance

International financial management ppt @ bec doms bagalkot mba finance

Foreign Exchange Risk Management (Currency Risk Management)

Foreign Exchange Risk Management (Currency Risk Management)

Econ315 Money and Banking: Learning Unit #13: Term Structure of Interest Rates

Econ315 Money and Banking: Learning Unit #13: Term Structure of Interest Rates

En vedette

En vedette (20)

The Ear (Its Structure, Nature and Mechanism) And Mechanism of Smell

The Ear (Its Structure, Nature and Mechanism) And Mechanism of Smell

8 Critical Sales Competencies and How to Improve Them

8 Critical Sales Competencies and How to Improve Them

Similaire à Summary of Ratio Analyses

Similaire à Summary of Ratio Analyses (20)

3.4 interpreting published accounts (part 2) - moodle

3.4 interpreting published accounts (part 2) - moodle

Analysis of Financial Statment Activity and Solvency ratios week 4.pptx

Analysis of Financial Statment Activity and Solvency ratios week 4.pptx

Chapter 05(a) financial analysis-ratio and other analysis

Chapter 05(a) financial analysis-ratio and other analysis

FIN 534 – FINANCIAL MANAGEMENTwithDr. charity ezenwa.docx

FIN 534 – FINANCIAL MANAGEMENTwithDr. charity ezenwa.docx

Plus de Trisha Lane Atienza

Plus de Trisha Lane Atienza (14)

The Tongue (Its Receptors and Factors that determine)

The Tongue (Its Receptors and Factors that determine)

Dernier

https://app.box.com/s/7hlvjxjalkrik7fb082xx3jk7xd7liz3TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...Nguyen Thanh Tu Collection

Mehran University Newsletter is a Quarterly Publication from Public Relations OfficeMehran University Newsletter Vol-X, Issue-I, 2024

Mehran University Newsletter Vol-X, Issue-I, 2024Mehran University of Engineering & Technology, Jamshoro

God is a creative God Gen 1:1. All that He created was “good”, could also be translated “beautiful”. God created man in His own image Gen 1:27. Maths helps us discover the beauty that God has created in His world and, in turn, create beautiful designs to serve and enrich the lives of others.

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...christianmathematics

Dernier (20)

General Principles of Intellectual Property: Concepts of Intellectual Proper...

General Principles of Intellectual Property: Concepts of Intellectual Proper...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

Presentation by Andreas Schleicher Tackling the School Absenteeism Crisis 30 ...

Presentation by Andreas Schleicher Tackling the School Absenteeism Crisis 30 ...

Energy Resources. ( B. Pharmacy, 1st Year, Sem-II) Natural Resources

Energy Resources. ( B. Pharmacy, 1st Year, Sem-II) Natural Resources

Mixin Classes in Odoo 17 How to Extend Models Using Mixin Classes

Mixin Classes in Odoo 17 How to Extend Models Using Mixin Classes

Beyond the EU: DORA and NIS 2 Directive's Global Impact

Beyond the EU: DORA and NIS 2 Directive's Global Impact

Measures of Central Tendency: Mean, Median and Mode

Measures of Central Tendency: Mean, Median and Mode

Unit-V; Pricing (Pharma Marketing Management).pptx

Unit-V; Pricing (Pharma Marketing Management).pptx

Python Notes for mca i year students osmania university.docx

Python Notes for mca i year students osmania university.docx

Basic Civil Engineering first year Notes- Chapter 4 Building.pptx

Basic Civil Engineering first year Notes- Chapter 4 Building.pptx

ICT Role in 21st Century Education & its Challenges.pptx

ICT Role in 21st Century Education & its Challenges.pptx

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...

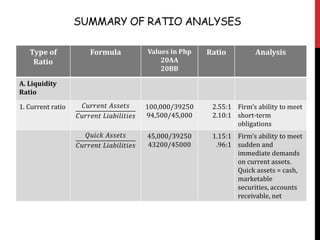

Summary of Ratio Analyses

- 1. SUMMARY OF RATIO ANALYSES Type of Ratio Formula Values in Php 20AA 20BB Ratio Analysis A. Liquidity Ratio 1. Current ratio 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 100,000/39250 94,500/45,000 2.55:1 2.10:1 Firm’s ability to meet short-term obligations 𝑄𝑢𝑖𝑐𝑘 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 45,000/39250 43200/45000 1.15:1 .96:1 Firm’s ability to meet sudden and immediate demands on current assets. Quick assets = cash, marketable securities, accounts receivable, net

- 2. Type of Ratio Formula Values in Php 20AA 20BB Ratio Analysis B. Activity Ratio 1. Inventory turnover 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 300,000/25,000 200,000/25,000 12 times 8 times Number of times the merchandise inventory was sold and replenished during the period 2. Days of sales in inventory Number of days in a period/Inventory turnover 365/12 365/8 30.22 days 45.63 days Number of days inventory is sold, from date acquired 3. Accounts receivable turnover 𝑁𝑒𝑡 𝑠𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 200,000/20,000 10 times Number of times receivables have been realized in sales 4. Average collection period Number of days in year/Receivable turnover 360/10 36 days Average number of days it takes to collect receivables

- 3. Type of Ratio Formula Values in Php 20AA 20BB Ratio Analysis 5. Asset turnover a. Fixed asset turnover 𝑁𝑒𝑡 𝑠𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑓𝑖𝑥𝑒𝑑 𝑎𝑠𝑠𝑒𝑡𝑠 200,000/67,500 2.96 How effectively fixed assets have been utilized to generate sales revenue b. Total assets turnover 𝑁𝑒𝑡 𝑠𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 200,000/187,250 1.07 Ability of the firm generating revenues; a measure of investment efficiency C. Leverage Ratios 1. Equity to debt ratio 𝑂𝑤𝑛𝑒𝑟′ 𝑠 𝐸𝑞𝑢𝑖𝑡𝑦 𝑇𝑜𝑡𝑎𝑙 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 100,750/99,250 79,500/95,000 1.02 .84 Shows the relationship between investors contributions and debt of the firm

- 4. Type of Ratio Formula Values in Php 20AA 20BB Ratio Analysis 2. Debt ratio 𝑇𝑜𝑡𝑎𝑙 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 99,250/200,000 95,000/174,500 .50 .54 Proportion of assets provided by creditors D. Profitability Ratios 1. Gross profit margin 𝐺𝑟𝑜𝑠𝑠 𝑃𝑟𝑜𝑓𝑖𝑡 𝑆𝑎𝑙𝑒𝑠 180,000/300,000 100,000/200,000 60% 50% Gross profit percentage on sales to recover operating expenses 2. Operating profit margin Earnings (before interest and taxes) / Sales 55,000/300,000 40,000/200,000 .18 .20 Operating profit percentage per peso of sales 3. Net profit margin Net profit (earnings after interest and taxes) / Sales 35,750/300,000 26,000/200,000 .12 .13 Profit percentage per peso of sales

- 5. Type of Ratio Formula Values in Php 20AA 20BB Ratio Analysis 4. Return on assets Net profit (earning after interest and taxes) / average total assets 26,000/187,250 14% Overall assets productivity 5. Return on equity 𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑜𝑤𝑛𝑒𝑟′ 𝑠 𝑒𝑞𝑢𝑖𝑡𝑦 26,000/90,125 29% Rate of net income earned based on owner’s equity

- 6. MARKETVALUES A firms’s value is related to what an investor will pay for its stock. If demand for the stock increases, then its price will also increase, wherein its increase in share price can be tied to expectation of increased in future earnings. Some of the tools that determine share prices are book value and earnings per share. Book value is the basis for the fairly determining the worth of the assets in relation to a holder’s share, upon liquidation of the firm. 𝐵𝑜𝑜𝑘 𝑣𝑎𝑙𝑢𝑒 = 𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠ℎ𝑎𝑟𝑒 𝑜𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

- 7. Earnings per share aims to identify the valid earnings per share value, by looking at trends over time or the earnings of other companies in the same industry. 𝐸𝑎𝑟𝑛𝑖𝑛𝑔 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 = 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 − 𝑝𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠ℎ𝑎𝑟𝑒𝑠 𝑜𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒−𝑒𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑟𝑎𝑡𝑖𝑜 = 𝑀𝑎𝑟𝑘𝑒𝑡 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑠𝑡𝑜𝑐𝑘 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒